How Will US Tariffs Affect the Stock Market?

author:US stockS -

Introduction

The stock market is a complex and dynamic entity, influenced by a myriad of factors, including economic policies, geopolitical events, and corporate earnings. One such factor that has been causing quite the stir in recent years is the implementation of tariffs by the United States government. This article delves into how these tariffs might impact the stock market, considering both the short-term and long-term effects.

Understanding Tariffs

Before we delve into the potential effects of tariffs on the stock market, it's important to understand what tariffs are. Tariffs are essentially taxes imposed on imported goods and services. The U.S. government has been imposing tariffs on various countries, including China, Mexico, and the European Union, in an attempt to address trade imbalances and protect domestic industries.

Short-Term Effects

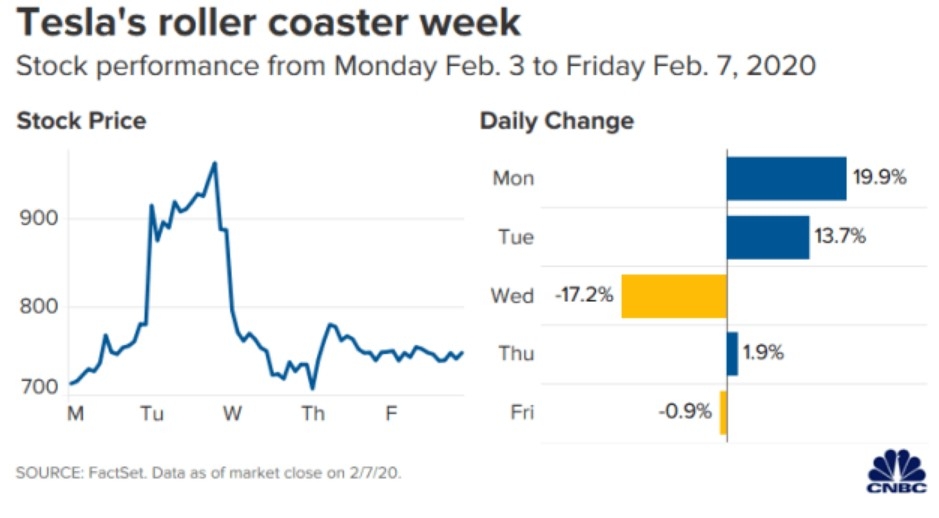

In the short term, the impact of tariffs on the stock market can be quite volatile. When tariffs are announced, it often leads to uncertainty in the market, causing stocks to fluctuate. Here are some of the short-term effects:

- Increased Costs: Companies that rely on imported goods may face increased costs due to tariffs. This can lead to a decrease in their profitability, which is reflected in their stock prices.

- Supply Chain Disruptions: Tariffs can disrupt supply chains, leading to delays in production and increased costs for businesses. This can also affect the stock prices of companies that are part of these supply chains.

- Investor Sentiment: Tariffs can create uncertainty among investors, leading to a sell-off of stocks. This can have a significant impact on stock prices, especially for companies that are heavily exposed to international trade.

Long-Term Effects

While the short-term effects of tariffs can be quite volatile, the long-term effects are more complex. Here are some of the potential long-term effects:

- Adaptation and Innovation: Over time, companies may adapt to the increased costs of tariffs by finding alternative suppliers or improving their production processes. This can lead to innovation and long-term growth.

- Shift in Trade Patterns: Tariffs can lead to a shift in trade patterns, with companies looking for new markets or suppliers. This can create opportunities for some companies while posing challenges for others.

- Global Economic Impact: Tariffs can have a broader impact on the global economy, potentially leading to slower economic growth and lower corporate earnings, which can affect the stock market as a whole.

Case Studies

To illustrate the potential impact of tariffs on the stock market, let's look at a couple of case studies:

- Nike: When the U.S. imposed tariffs on Chinese goods, Nike, which relies heavily on Chinese manufacturing, experienced a decline in its stock price. However, over time, the company managed to adapt by finding alternative suppliers and improving its production processes, leading to a recovery in its stock price.

- Apple: Apple, another company heavily exposed to international trade, also faced challenges due to tariffs. However, the company's strong financial position and diverse product portfolio helped it navigate these challenges, leading to a relatively stable stock price.

Conclusion

In conclusion, while tariffs can have a significant impact on the stock market, both in the short and long term, the actual effects can vary widely depending on the specific circumstances. It's important for investors to stay informed and understand the potential risks and opportunities associated with tariffs.

dow and nasdaq today