How Did the US Stock Market End 2018?

author:US stockS -

As the year 2018 came to a close, investors and market analysts alike were eager to know how the US stock market performed. This article delves into the key factors that influenced the market in 2018 and provides an overview of its performance at the end of the year.

Market Performance in Review

In 2018, the US stock market experienced a rollercoaster ride, with several ups and downs. The year started with strong momentum, but it gradually lost steam as various factors came into play. The S&P 500, a widely followed index that tracks the performance of 500 large companies, ended the year with a negative return.

Factors Influencing the Stock Market

Several factors contributed to the US stock market's performance in 2018. Here are some of the key factors:

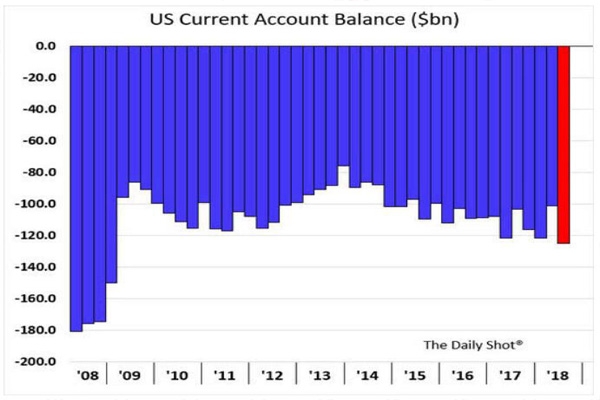

Trade Tensions: The escalating trade tensions between the US and other major economies, particularly China, played a significant role in the market's volatility. Investors were concerned about the potential impact of tariffs on global trade and economic growth.

Economic Growth: While the US economy continued to grow in 2018, concerns about the sustainability of this growth led to market uncertainty. Some investors worried that the strong economic performance might lead to higher inflation and interest rates, which could negatively impact stocks.

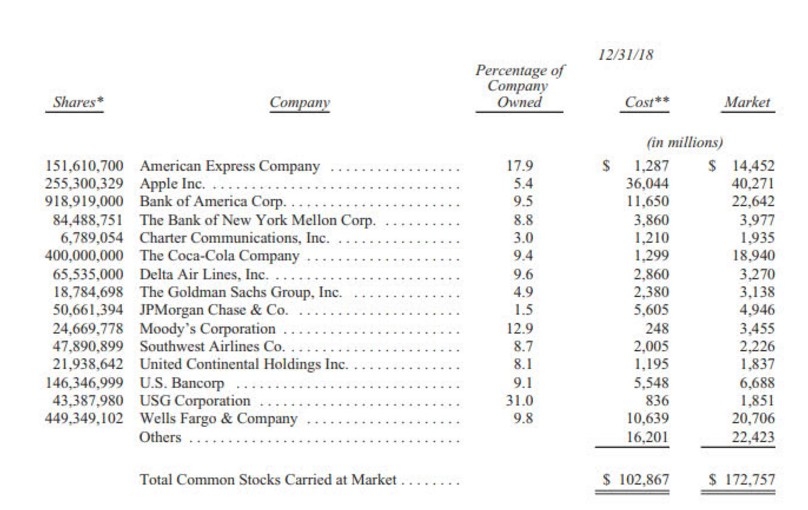

Corporate Profits: Despite the market's overall negative performance, many companies reported strong earnings. However, investors were cautious about the sustainability of these profits, especially given the economic and political uncertainties.

Political Factors: The political environment, including midterm elections and policy changes, also influenced the stock market. Investors were closely watching for any potential policy changes that could impact the market.

Market Performance at the End of 2018

At the end of 2018, the US stock market showed mixed results. Here's a breakdown of the key indices:

S&P 500: The S&P 500 index ended the year with a negative return, marking the first annual decline since 2015. The index lost approximately 6.2% in value during the year.

Dow Jones Industrial Average: The Dow Jones Industrial Average also experienced a negative return, dropping by about 5.6% in 2018.

NASDAQ Composite: The NASDAQ Composite, which tracks technology stocks, performed slightly better than the other two indices, with a loss of approximately 4.3% for the year.

Case Studies

Several high-profile companies faced challenges in 2018. For example, tech giant Apple reported a decline in iPhone sales, which impacted its stock performance. Similarly, energy companies faced challenges due to falling oil prices, leading to a decline in their stock prices.

Conclusion

In summary, the US stock market ended 2018 with a negative return, influenced by factors such as trade tensions, economic growth concerns, and political uncertainties. While some companies reported strong earnings, the overall market performance was impacted by these broader factors. Investors will be closely watching these factors in 2019 as they continue to navigate the volatile stock market.

dow and nasdaq today