Green Stocks US: Investing in the Future of Sustainability

author:US stockS -

In the rapidly evolving landscape of the global economy, the concept of sustainability has become a pivotal factor in investment decisions. As environmental concerns intensify, green stocks have emerged as a promising sector for investors seeking both financial returns and a positive impact on the planet. This article delves into the world of green stocks in the United States, highlighting key trends, investment opportunities, and the potential for long-term growth.

What Are Green Stocks?

Green stocks are shares of companies that are involved in environmentally friendly industries or are committed to sustainable practices. These companies often focus on renewable energy, clean technology, green construction, and sustainable agriculture. By investing in green stocks, investors can align their financial interests with their environmental values.

The Rise of Green Stocks in the US

The United States has been at the forefront of the green stock movement. The growing awareness of climate change and the increasing demand for sustainable products and services have fueled the growth of this sector. In recent years, numerous green stocks have experienced significant growth, outperforming traditional sectors in many cases.

Key Green Stock Categories

Several categories of green stocks have gained prominence in the US market:

Renewable Energy: Companies involved in the production and distribution of renewable energy sources, such as solar, wind, and hydroelectric power, have seen substantial growth. Notable players include Tesla (TSLA) and First Solar (FSLR).

Clean Technology: This category encompasses companies that develop and implement innovative technologies to reduce environmental impact. NVIDIA (NVDA) and Intel (INTC) are examples of companies with a strong focus on clean technology.

Green Construction: Companies that specialize in sustainable building materials and practices are increasingly sought after. Piedmont Natural Gas (PNY) and KB Home (KBH) are prominent players in this sector.

Sustainable Agriculture: Companies that focus on sustainable farming practices and organic products have seen significant growth. Whole Foods Market (WFM) and Chobani are notable examples.

Investing in Green Stocks

Investing in green stocks requires careful research and analysis. Here are some key considerations:

Company Financials: Evaluate the financial health of the company, including revenue growth, profit margins, and debt levels.

Market Trends: Stay informed about market trends and regulatory changes that may impact the green stock sector.

ESG Factors: Consider the company's environmental, social, and governance (ESG) practices to ensure it aligns with your values.

Dividend Yield: Some green stocks may offer attractive dividend yields, providing a steady income stream.

Case Studies

Tesla: Tesla has been a standout performer in the green stock sector, with its stock price skyrocketing in recent years. The company's commitment to electric vehicles and renewable energy has propelled its growth, making it a leader in the green stock market.

First Solar: First Solar has also experienced significant growth, driven by its focus on solar energy solutions. The company's innovative technology and strong financial performance have made it a favorite among green stock investors.

Conclusion

Green stocks offer a unique opportunity for investors to invest in the future of sustainability. By carefully selecting companies with strong financials and a commitment to environmental responsibility, investors can benefit from both financial returns and a positive impact on the planet. As the demand for sustainable products and services continues to grow, green stocks are poised to play a crucial role in shaping the future of the global economy.

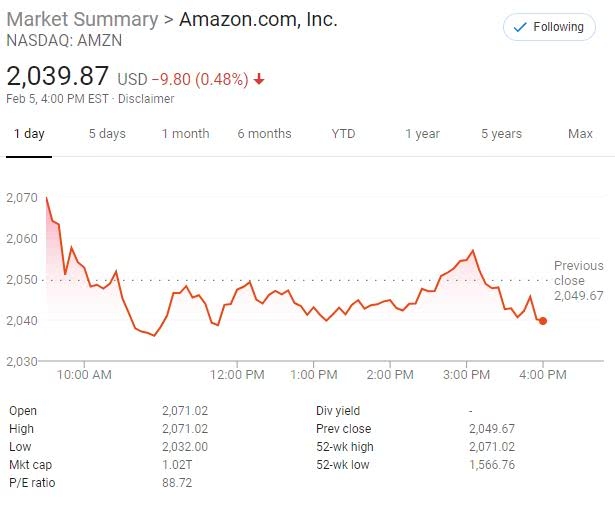

dow and nasdaq today