FactSet US vs. International Stock Performance: A Comparative Analysis

author:US stockS -

In the ever-evolving world of finance, understanding the performance of stocks across different regions is crucial for investors. This article delves into a comparative analysis of FactSet US stock performance versus international stock performance. By examining key metrics and trends, we aim to provide valuable insights for investors looking to diversify their portfolios.

Introduction to FactSet

Firstly, it's important to understand what FactSet is. FactSet is a global provider of integrated financial information and analytical applications, delivering the insights that investment professionals need to make informed decisions. Their comprehensive database covers a wide range of financial instruments, including stocks, bonds, and derivatives.

US Stock Performance

When it comes to US stock performance, the S&P 500 has been a popular benchmark. Over the past decade, the S&P 500 has delivered impressive returns, with an average annual return of around 10%. This performance can be attributed to several factors, including strong economic growth, low unemployment rates, and technological advancements.

International Stock Performance

In contrast, international stock performance has been somewhat mixed. While some regions, such as Asia and Europe, have seen significant growth, others, such as Latin America and Africa, have struggled. The MSCI World Index, which tracks stocks in developed markets, has returned an average of 6% annually over the same period.

Factors Influencing Stock Performance

Several factors influence stock performance, both domestically and internationally. These include economic conditions, political stability, corporate earnings, and market sentiment. Here's a closer look at some of the key factors:

- Economic Conditions: A strong economy often correlates with strong stock performance. This is because companies tend to see increased revenue and profit when the economy is growing.

- Political Stability: Political instability can lead to uncertainty and volatility in the stock market. Regions with stable governments and political systems often see more consistent stock performance.

- Corporate Earnings: Companies with strong earnings tend to perform well in the stock market. This is because investors are willing to pay a premium for companies that are generating consistent profits.

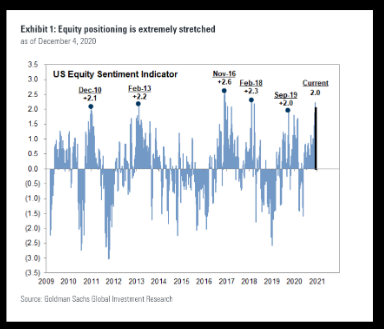

- Market Sentiment: The overall mood of the market can have a significant impact on stock performance. Factors such as news, rumors, and market trends can all influence investor sentiment.

Case Studies

To illustrate the differences in stock performance, let's look at a few case studies:

- Apple (AAPL): Over the past decade, Apple has been a top performer in the US stock market. The company's strong product lineup, innovative technology, and global presence have contributed to its impressive growth.

- Nokia (NOK): In contrast, Nokia has struggled in the international market. The company's failure to adapt to the smartphone era has led to declining sales and market share.

- Baidu (BIDU): Baidu, a Chinese search engine company, has seen significant growth in the Asian market. However, regulatory challenges and competition from domestic players have posed challenges for the company.

Conclusion

In conclusion, the performance of stocks in the US versus international markets can vary significantly. Understanding the factors that influence stock performance and analyzing historical data can help investors make informed decisions. By diversifying their portfolios, investors can mitigate risk and potentially maximize returns.

dow and nasdaq today