Biggest Stock Brokers in the US: Leading the Financial Landscape

author:US stockS -

Introduction

The stock brokerage industry is a cornerstone of the financial sector in the United States, with numerous firms vying for a piece of the multi-trillion-dollar market. In this article, we delve into the biggest stock brokers in the US, exploring their market presence, services, and the impact they have on the financial landscape.

The Top Stock Brokers in the US

Merrill Edge

- Market Presence: Merrill Edge is a division of Bank of America, offering a comprehensive suite of financial services.

- Services: This platform provides investors with access to a wide range of investment options, including stocks, bonds, mutual funds, and ETFs.

- Impact: Merrill Edge is known for its user-friendly interface and robust research tools, making it a popular choice among both novice and experienced investors.

Charles Schwab

- Market Presence: Charles Schwab is one of the largest brokerage firms in the US, with a significant market share.

- Services: The firm offers a wide array of investment products, including stocks, bonds, mutual funds, and ETFs, along with advanced trading tools.

- Impact: Schwab is renowned for its competitive pricing and customer service, making it a go-to choice for many investors.

E*TRADE

- Market Presence: E*TRADE is a well-known brokerage firm, with a strong presence in the retail investment market.

- Services: This platform provides access to a wide range of investment options, including stocks, bonds, mutual funds, and ETFs, as well as advanced trading tools.

- Impact: E*TRADE is known for its innovative trading technology and user-friendly interface, making it a popular choice among tech-savvy investors.

Fidelity

- Market Presence: Fidelity is one of the largest and most respected brokerage firms in the US.

- Services: The firm offers a comprehensive range of investment products, including stocks, bonds, mutual funds, and ETFs, along with retirement planning and financial advice.

- Impact: Fidelity is recognized for its exceptional customer service and robust research tools, making it a preferred choice for many investors.

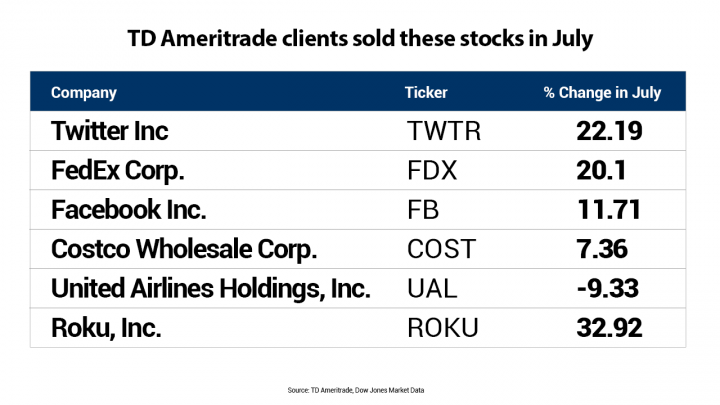

TD Ameritrade

- Market Presence: TD Ameritrade is a leading brokerage firm, with a significant market share.

- Services: This platform provides access to a wide range of investment options, including stocks, bonds, mutual funds, and ETFs, as well as advanced trading tools.

- Impact: TD Ameritrade is known for its powerful trading tools, extensive research resources, and exceptional customer service.

Case Studies

- Merrill Edge: A case study on Merrill Edge highlights its success in attracting younger investors through its innovative mobile app and user-friendly interface.

- Charles Schwab: Another case study showcases Charles Schwab's ability to cater to both novice and experienced investors through its diverse range of investment products and competitive pricing.

- E*TRADE: A case study on E*TRADE demonstrates its commitment to innovation, as evidenced by its integration of social media and trading tools.

- Fidelity: A case study on Fidelity highlights its strong focus on customer service and research tools, which have helped it maintain its position as a leading brokerage firm.

- TD Ameritrade: A case study on TD Ameritrade showcases its commitment to providing advanced trading tools and resources, making it a popular choice among active traders.

Conclusion

The biggest stock brokers in the US play a crucial role in the financial landscape, providing investors with a wide range of investment options and services. Whether you're a novice or an experienced investor, these firms offer tailored solutions to meet your investment needs.

dow and nasdaq today