Current US Stock Market CAPE Ratio: A Comprehensive Analysis

author:US stockS -

The CAPE Ratio, or the Cyclically Adjusted Price-to-Earnings Ratio, is a vital tool for investors looking to gauge the valuation of the US stock market. This metric, developed by Nobel laureate Robert Shiller, adjusts the standard P/E ratio by smoothing out the earnings over a business cycle, providing a clearer picture of market valuation. In this article, we delve into the current CAPE Ratio of the US stock market, its implications, and what it means for investors.

Understanding the CAPE Ratio

The CAPE Ratio is calculated by dividing the total market value of all stocks by the average inflation-adjusted earnings of the S&P 500 companies over the past 10 years. This metric helps investors to understand whether the stock market is overvalued, undervalued, or fairly valued.

Current CAPE Ratio and Its Implications

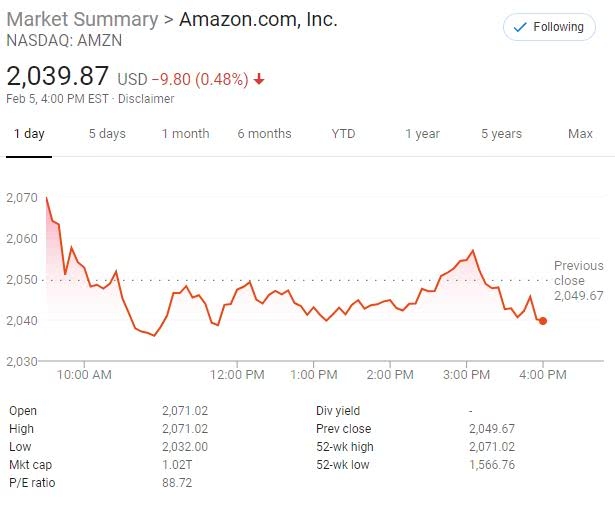

As of the latest data, the CAPE Ratio stands at around 32.5. This indicates that the US stock market is moderately overvalued. Historically, a CAPE Ratio above 30 has been considered overvalued, while a ratio below 20 has been considered undervalued.

What Does This Mean for Investors?

A moderately overvalued CAPE Ratio suggests that the stock market may not offer significant value at the moment. However, it's important to note that the CAPE Ratio is just one of many tools available to investors. It's crucial to consider other factors such as economic conditions, interest rates, and market sentiment.

Case Study: The Dot-Com Bubble

One of the most notable examples of the CAPE Ratio being a reliable indicator of market valuation is the dot-com bubble of the late 1990s. At its peak, the CAPE Ratio soared to over 43, signaling extreme overvaluation. As a result, the stock market experienced a significant correction, with the NASDAQ index losing over 80% of its value.

Future Outlook

The future of the CAPE Ratio is uncertain, as it depends on various economic and market factors. However, it's important for investors to remain vigilant and not get caught up in the hype of a potentially overvalued market.

Conclusion

The current CAPE Ratio of the US stock market suggests that it may be moderately overvalued. While this doesn't necessarily mean a market crash is imminent, it does serve as a cautionary signal for investors. By considering the CAPE Ratio along with other factors, investors can make more informed decisions and avoid potential pitfalls.

dow and nasdaq today