Car Dealers in China: A US Stock Market Perspective

author:US stockS -

In the ever-evolving global automotive industry, car dealerships in China have become a significant investment opportunity for US stock market investors. With the world's largest automotive market, China presents a unique landscape for car dealerships, offering both challenges and opportunities. This article delves into the dynamics of car dealerships in China and their potential impact on US stock markets.

The Chinese Automotive Market

China has long been the world's largest automotive market, with sales exceeding those of the United States and Europe combined. This massive market has attracted numerous international car manufacturers, and as a result, the demand for car dealerships has surged. Car dealerships in China operate in a highly competitive environment, with both domestic and international brands vying for market share.

Investment Opportunities

For US stock market investors, car dealerships in China represent a promising investment opportunity. Several publicly-traded companies have a significant presence in the Chinese market, making them viable options for investment. Here are a few notable examples:

Ferrari N.V. (RACE): As one of the most prestigious car brands, Ferrari has a strong presence in China. Ferrari N.V. is a publicly-traded company listed on the New York Stock Exchange, offering investors a chance to invest in one of the world's most exclusive car manufacturers.

Tesla, Inc. (TSLA): Tesla has made significant strides in the Chinese market, with plans to expand its production and sales operations in the country. As a leading electric vehicle (EV) manufacturer, Tesla's success in China could translate to substantial growth for its US stock.

Audi AG (NSUGY): Audi, a luxury car manufacturer, has a significant presence in China. Audi AG is a German company listed on the Frankfurt Stock Exchange, but its US-listed American Depositary Receipts (ADRs) offer a way for US investors to gain exposure to the Chinese market.

Challenges and Risks

Despite the attractive investment opportunities, car dealerships in China face several challenges and risks. These include:

- Competition: The intense competition in the Chinese automotive market can lead to price wars and reduced profit margins for car dealerships.

- Regulatory Changes: China's government has implemented various regulations aimed at curbing pollution and promoting the adoption of EVs, which could impact the operations of car dealerships.

- Economic Uncertainty: Economic fluctuations in China can affect consumer spending and, subsequently, the demand for cars.

Case Study: Tesla's Expansion in China

A prime example of a company that has successfully navigated the Chinese market is Tesla, Inc. Tesla has invested heavily in China, establishing a Gigafactory in Shanghai and expanding its sales and service network across the country. This strategic move has paid off, with Tesla's sales in China growing significantly year over year.

Conclusion

Investing in car dealerships in China through US stocks can be a lucrative opportunity for investors looking to diversify their portfolios. However, it is crucial to carefully assess the risks and challenges associated with the Chinese automotive market before making investment decisions. By staying informed and monitoring the performance of companies with a presence in China, investors can capitalize on the potential growth of this dynamic market.

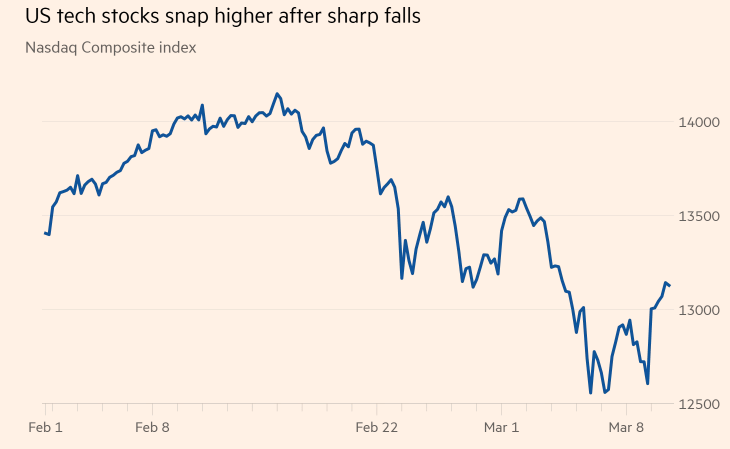

dow and nasdaq today