Can I Buy BYD Stock in the US?

author:US stockS -

Are you interested in investing in BYD, the Chinese multinational company known for its electric vehicles and renewable energy solutions? If so, you might be wondering if you can purchase BYD stock in the US. In this article, we'll explore the process of buying BYD stock and discuss the factors you should consider before making your investment.

Understanding BYD

BYD, short for "Build Your Dreams," is a Chinese company that has made significant strides in the global market. It was founded in 1995 and has since grown to become one of the world's leading manufacturers of electric vehicles, batteries, and solar panels. The company is listed on the Shenzhen Stock Exchange and is known for its innovative technology and commitment to sustainability.

Can You Buy BYD Stock in the US?

Yes, you can buy BYD stock in the US. However, there are a few things you need to keep in mind:

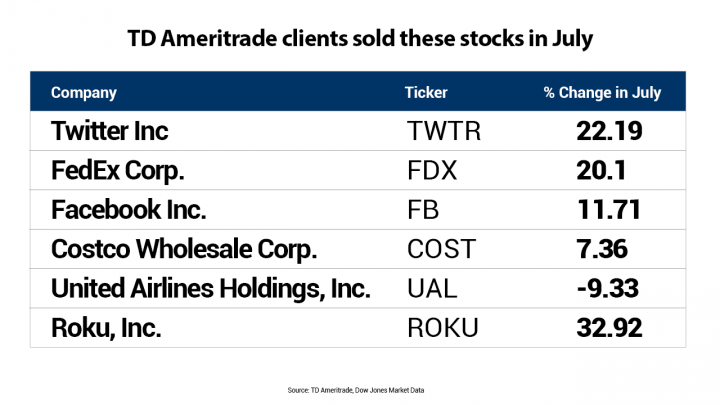

Trading Platform: To purchase BYD stock, you'll need to have a brokerage account. You can open an account with a reputable online brokerage firm, such as TD Ameritrade, E*TRADE, or Fidelity. These platforms offer access to a wide range of stocks, including those listed on foreign exchanges.

Trading Hours: BYD is listed on the Shenzhen Stock Exchange, which operates from 9:30 AM to 11:30 AM and 1:00 PM to 3:00 PM in China Standard Time. However, you can trade BYD stock in the US during regular trading hours, which are from 9:30 AM to 4:00 PM Eastern Time.

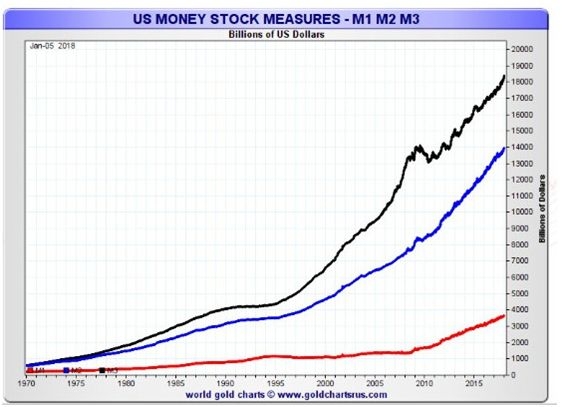

Currency Conversion: Since BYD is a Chinese company, its stock is priced in Chinese Yuan. When you purchase BYD stock, your brokerage firm will convert the currency to US dollars. Be aware that currency conversion fees may apply.

Factors to Consider Before Investing in BYD Stock

Market Volatility: The stock market can be volatile, and foreign stocks may be more susceptible to market fluctuations. It's important to research the market conditions and understand the risks associated with investing in a foreign stock.

Economic and Political Factors: The economic and political situation in China can impact the performance of BYD stock. Keep an eye on factors such as trade policies, currency exchange rates, and political stability.

Company Performance: Evaluate BYD's financial performance, including revenue, earnings, and growth prospects. Look for trends and compare them to other companies in the industry.

Case Study: Tesla vs. BYD

One of BYD's main competitors in the electric vehicle market is Tesla. While Tesla is a US-based company, it's worth comparing the two to understand the differences between domestic and foreign stocks.

Tesla has been successful in the US market, thanks to its innovative technology and strong brand. However, Tesla's stock has experienced significant volatility, which can be attributed to various factors, including production challenges and regulatory issues.

BYD, on the other hand, has made significant inroads in the Chinese market and is expanding its presence globally. The company has a strong focus on renewable energy and electric mobility, which aligns with the growing demand for sustainable transportation solutions.

Conclusion

Buying BYD stock in the US is possible, but it's important to conduct thorough research and consider the associated risks. Evaluate the company's performance, market conditions, and economic and political factors before making your investment decision. Remember, investing in foreign stocks requires a higher level of due diligence and risk tolerance.

dow and nasdaq today