Can H1B Buy Stocks in the US? A Comprehensive Guide

author:US stockS -

Introduction

The H1B visa, a non-immigrant visa in the United States, allows U.S. employers to temporarily employ foreign workers in specialty occupations. With the visa comes a host of opportunities, including the possibility of investing in the U.S. stock market. But can H1B visa holders buy stocks in the U.S.? This article delves into this question, providing a comprehensive guide for H1B visa holders interested in investing in U.S. stocks.

Understanding the H1B Visa and Its Financial Implications

The H1B visa is a valuable tool for both employers and employees. For employees, it offers a chance to work in the U.S., gain valuable experience, and potentially earn higher salaries. However, it also comes with certain financial implications, including restrictions on certain types of investments.

Can H1B Visa Holders Buy Stocks in the U.S.?

Yes, H1B visa holders can buy stocks in the U.S. However, it's important to understand the rules and regulations surrounding this investment opportunity. Here's what you need to know:

1. Tax Implications

One of the most significant factors to consider is the tax implications of investing in U.S. stocks as an H1B visa holder. Generally, H1B visa holders are considered non-resident aliens for tax purposes. This means that they are subject to different tax rules compared to U.S. citizens or residents.

2. Investment Options

H1B visa holders have several investment options when it comes to U.S. stocks. They can:

- Open a brokerage account and buy individual stocks.

- Invest in mutual funds or exchange-traded funds (ETFs) that include U.S. stocks.

- Purchase shares of U.S. companies through a dividend reinvestment plan (DRIP).

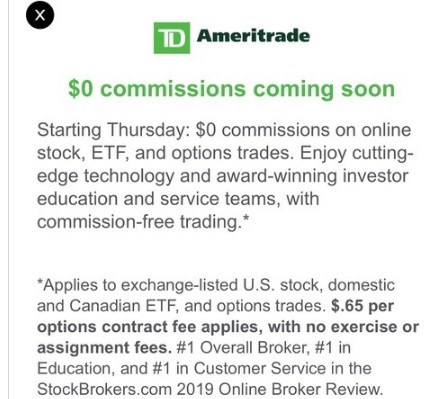

3. Brokerage Account Requirements

To buy stocks in the U.S., H1B visa holders need to open a brokerage account. However, it's important to choose a brokerage firm that caters to non-resident aliens. Some key factors to consider include:

- The firm's experience with H1B visa holders.

- The fees associated with opening and maintaining the account.

- The availability of educational resources and customer support.

4. Case Studies

Here are a few case studies of H1B visa holders who successfully invested in U.S. stocks:

- John: A software engineer from India, John opened a brokerage account with a firm that catered to non-resident aliens. He invested in a mix of individual stocks and ETFs, and within a few years, his investments had grown significantly.

- Sarah: A research scientist from the UK, Sarah invested in a DRIP for a U.S. pharmaceutical company. She reinvested her dividends, and over time, her investment had grown to a substantial amount.

Conclusion

In conclusion, H1B visa holders can buy stocks in the U.S., but it's important to understand the rules and regulations surrounding this investment opportunity. By doing so, they can take advantage of the potential benefits of investing in the U.S. stock market while minimizing their tax obligations.

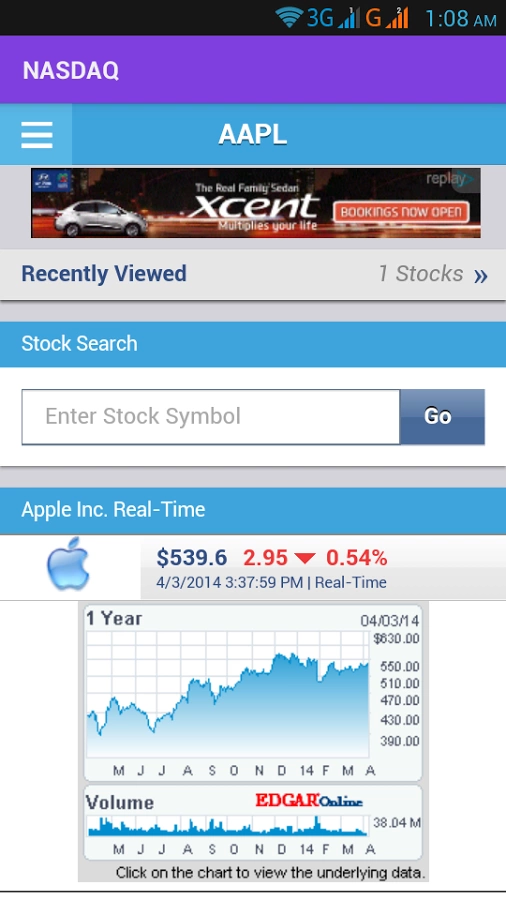

dow and nasdaq today