NVAX Premarket Stock Price: Everything You Need to Know

author:US stockS -NVAX(2)Premarket(5)Eve(2)Stock(238)Price(113)

In the fast-paced world of stock market trading, staying informed about the premarket stock prices of companies like NVAX can be the difference between making a profitable investment and missing out on valuable opportunities. This article delves into everything you need to know about NVAX premarket stock price, including key factors that influence it and how to interpret the information effectively.

Understanding NVAX Premarket Stock Price

What is NVAX? NVAX, short for Novavax, Inc., is a biotechnology company known for developing and manufacturing vaccines for infectious diseases. The company's focus is on producing next-generation vaccines that offer innovative and effective solutions to protect public health.

What is the NVAX Premarket Stock Price? The NVAX premarket stock price refers to the price at which NVAX shares are trading before the market opens for regular trading hours. This price can offer insights into investors' expectations and the company's potential for growth or decline before the trading day begins.

Factors Influencing NVAX Premarket Stock Price

Several factors can influence the NVAX premarket stock price:

1. Earnings Reports Positive earnings reports can drive up the stock price, while negative reports can lead to a decline. For example, when NVAX reported strong earnings results, its stock price surged, indicating investor confidence in the company's financial health and future prospects.

2. Market Sentiment The overall sentiment of the stock market can also impact NVAX's premarket stock price. During times of economic uncertainty, investors may seek safer investments, leading to a potential decline in NVAX's stock price. Conversely, during periods of economic optimism, NVAX's stock price may rise due to increased investor confidence.

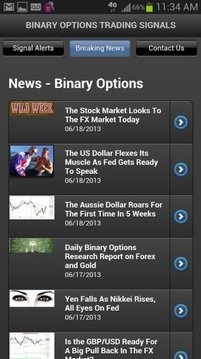

3. News and Announcements Breaking news, such as clinical trial results, partnerships, or regulatory approvals, can significantly affect NVAX's premarket stock price. For instance, when NVAX received approval for its COVID-19 vaccine candidate, the stock price soared due to the positive market reception of the announcement.

4. Competitor Activity The performance of NVAX's competitors can also impact its stock price. If competitors are experiencing success or facing challenges, it may affect NVAX's market position and, consequently, its stock price.

Interpreting NVAX Premarket Stock Price

To effectively interpret the NVAX premarket stock price, consider the following:

1. Historical Performance Analyzing NVAX's historical stock price trends can help you identify patterns and potential areas of growth or decline.

2. News and Announcements Stay updated on the latest news and announcements related to NVAX and its industry. This information can provide insights into potential future developments and their impact on the stock price.

3. Financial Ratios Examining NVAX's financial ratios, such as price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio, can provide additional context for understanding the stock price.

4. Technical Analysis Technical analysis involves analyzing past stock price movements to predict future trends. By studying NVAX's stock chart, you can identify support and resistance levels and potential entry or exit points for your investment.

Conclusion

Understanding the NVAX premarket stock price requires considering various factors, including earnings reports, market sentiment, news and announcements, and competitor activity. By staying informed and utilizing effective interpretation methods, you can make more informed investment decisions and potentially capitalize on opportunities within the NVAX stock.

dow and nasdaq today