Unlocking the Secrets of US Stock Closing Prices

author:US stockS -

In the dynamic world of finance, understanding the US stock closing price is crucial for investors and traders alike. This article delves into the significance of stock closing prices, how they are determined, and the factors that influence them. By the end, you'll have a clearer understanding of how to interpret and utilize this vital piece of financial information.

What is the US Stock Closing Price?

The US stock closing price refers to the final price at which a stock is traded on a given day. It is typically determined by the last trade of the day, but can also be influenced by market orders and automated trading systems. This price is crucial for investors as it helps them track their investments and make informed decisions.

How is the US Stock Closing Price Determined?

The US stock closing price is determined by the supply and demand for a particular stock. When more buyers are willing to pay a higher price for a stock than sellers are willing to accept, the stock price increases. Conversely, when more sellers are willing to sell at a lower price than buyers are willing to pay, the stock price decreases.

Factors Influencing the US Stock Closing Price

Several factors can influence the US stock closing price, including:

- Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation can affect investor sentiment and, subsequently, stock prices.

- Company Performance: The financial performance of a company, including its earnings reports, revenue growth, and profit margins, can significantly impact its stock price.

- Market Sentiment: The overall mood of the market can drive stock prices. For example, during a bull market, investors may be more optimistic, leading to higher stock prices, while during a bear market, investors may be more cautious, leading to lower stock prices.

- Political Events: Political events, such as elections or policy changes, can also influence stock prices.

Analyzing the US Stock Closing Price

To analyze the US stock closing price, investors and traders often use various tools and techniques, including:

- Technical Analysis: Technical analysis involves studying historical price and volume data to identify patterns and trends. This can help investors predict future price movements.

- Fundamental Analysis: Fundamental analysis involves evaluating a company's financial statements, industry position, and economic outlook. This can help investors determine the intrinsic value of a stock.

- Sentiment Analysis: Sentiment analysis involves analyzing the tone of news articles, social media posts, and other sources to gauge investor sentiment.

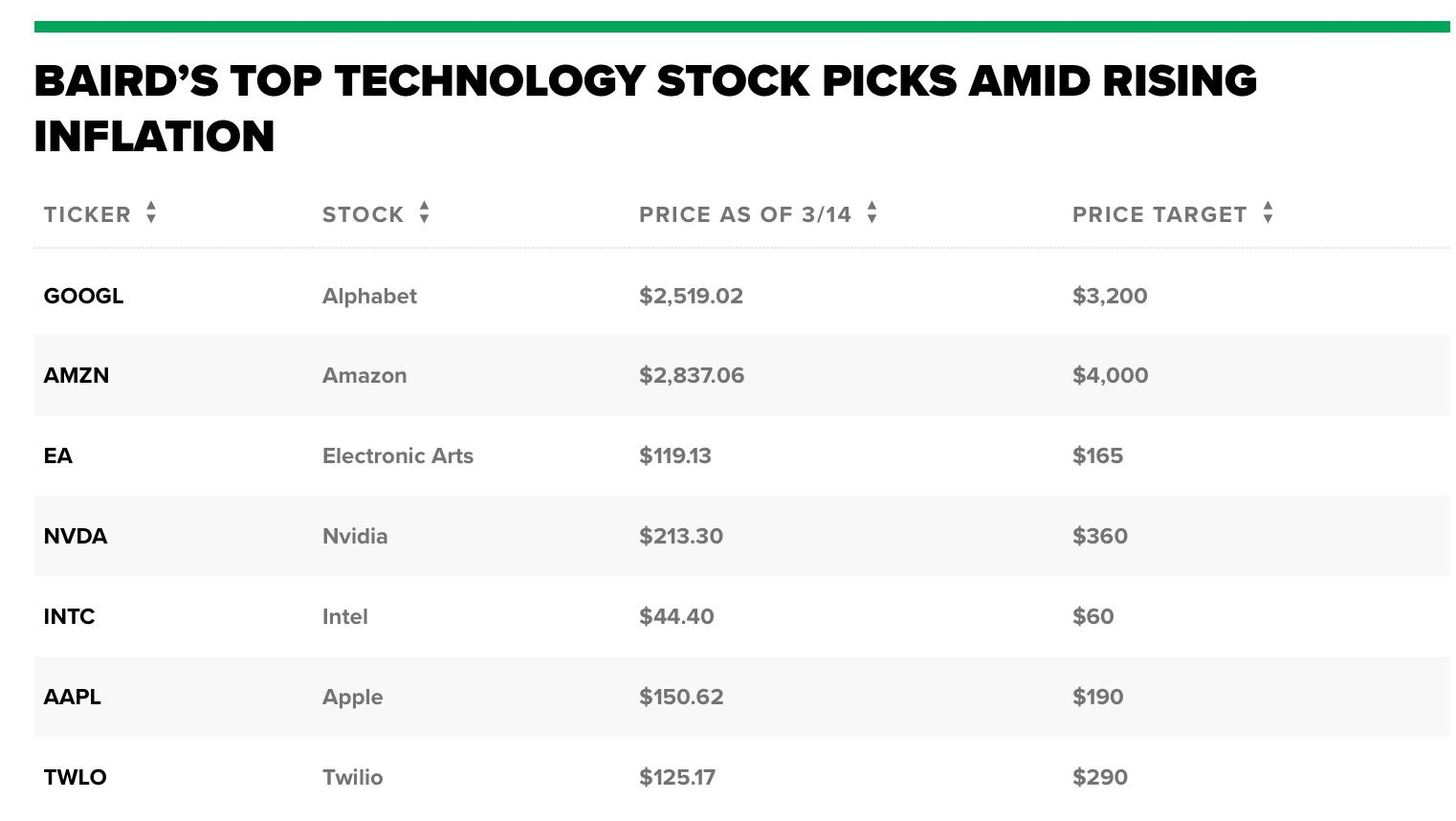

Case Study: Apple Inc. (AAPL)

Let's take a look at a case study involving Apple Inc. (AAPL). In the first quarter of 2021, Apple reported strong earnings, leading to a surge in its stock price. The company's strong revenue growth and increased product demand contributed to this positive sentiment. As a result, the US stock closing price for AAPL increased significantly during this period.

Conclusion

Understanding the US stock closing price is essential for anyone involved in the stock market. By analyzing the factors that influence stock prices and utilizing various tools and techniques, investors and traders can make more informed decisions. Whether you're a seasoned investor or just starting out, knowing how to interpret the US stock closing price can give you a competitive edge in the market.

us stock market today live cha