Understanding the US 100 Index: A Comprehensive Guide

author:US stockS -

The US 100 Index, also known as the Wilshire 100 Total Market Index, is a crucial benchmark for investors looking to gauge the overall performance of the U.S. stock market. This index represents the broadest possible view of the U.S. equity market, including all U.S. exchange-listed equity securities with a market capitalization of at least $300 million. In this article, we'll delve into the key aspects of the US 100 Index, its significance, and how it can be used to inform investment decisions.

What is the US 100 Index?

The US 100 Index is designed to track the performance of the entire U.S. equity market, providing a comprehensive view of the market's overall health. Unlike other indices that focus on specific sectors or market capitalizations, the US 100 Index includes companies from all sectors and market capitalizations, making it a more representative indicator of the market's performance.

Key Features of the US 100 Index

Inclusion Criteria: To be included in the US 100 Index, a company must have a market capitalization of at least $300 million and be listed on a U.S. exchange. This ensures that the index captures a broad range of companies across various industries.

Sector Representation: The US 100 Index includes companies from all sectors, providing a balanced view of the market. This helps investors understand the overall market trend rather than focusing on specific sectors.

Market Capitalization: The index includes companies with market capitalizations ranging from small-cap to large-cap, offering a comprehensive view of the market.

Significance of the US 100 Index

Market Performance: The US 100 Index serves as a key indicator of the overall performance of the U.S. stock market. By tracking the performance of a broad range of companies, it provides a more accurate representation of the market's health.

Investment Strategy: Investors can use the US 100 Index to inform their investment strategies. For instance, if the index is rising, it may indicate a strong market and be a good time to invest. Conversely, if the index is falling, it may signal a weakening market and be a time to be cautious.

Market Trends: The US 100 Index can help investors identify market trends. For example, if the index shows a significant increase in a particular sector, it may indicate that the sector is performing well and could be a good investment opportunity.

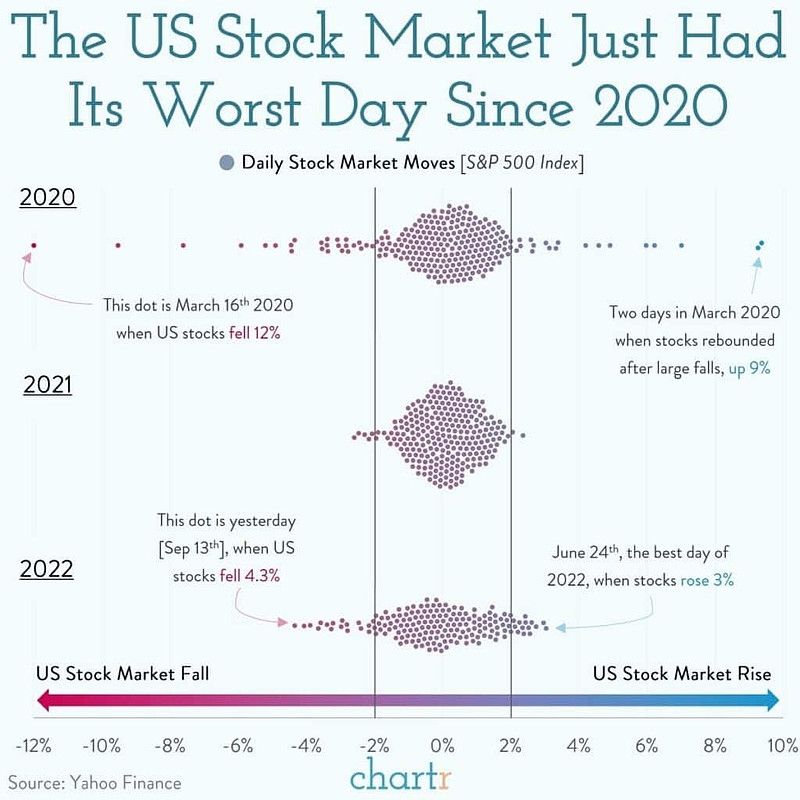

Case Study: The US 100 Index in 2020

In 2020, the US 100 Index faced significant challenges due to the COVID-19 pandemic. The index experienced a sharp decline in March, reflecting the market's reaction to the pandemic. However, as the year progressed, the index recovered and ended the year with a positive return. This case study highlights the importance of the US 100 Index in understanding the market's performance and making informed investment decisions.

Conclusion

The US 100 Index is a valuable tool for investors looking to gauge the overall performance of the U.S. stock market. By providing a comprehensive view of the market, it helps investors make informed investment decisions and identify market trends. Whether you're a seasoned investor or just starting out, understanding the US 100 Index can help you navigate the complex world of the stock market.

us stock market today live cha