Understanding the Penny Stock Exchange in the US

author:US stockS -

In the world of finance, the term "penny stock exchange US" refers to the trading of stocks that are priced below $5 per share. These stocks are often overlooked by many investors due to their low price, but they can offer significant opportunities for those who know how to navigate the market. In this article, we'll delve into the basics of the penny stock exchange in the United States, including its unique characteristics, risks, and potential rewards.

What Are Penny Stocks?

Penny stocks are shares of publicly traded companies that are priced below $5. These companies are typically smaller and less established than their larger counterparts, which can make them riskier investments. However, they also offer the potential for high returns, especially if the company experiences significant growth.

The Characteristics of the Penny Stock Exchange

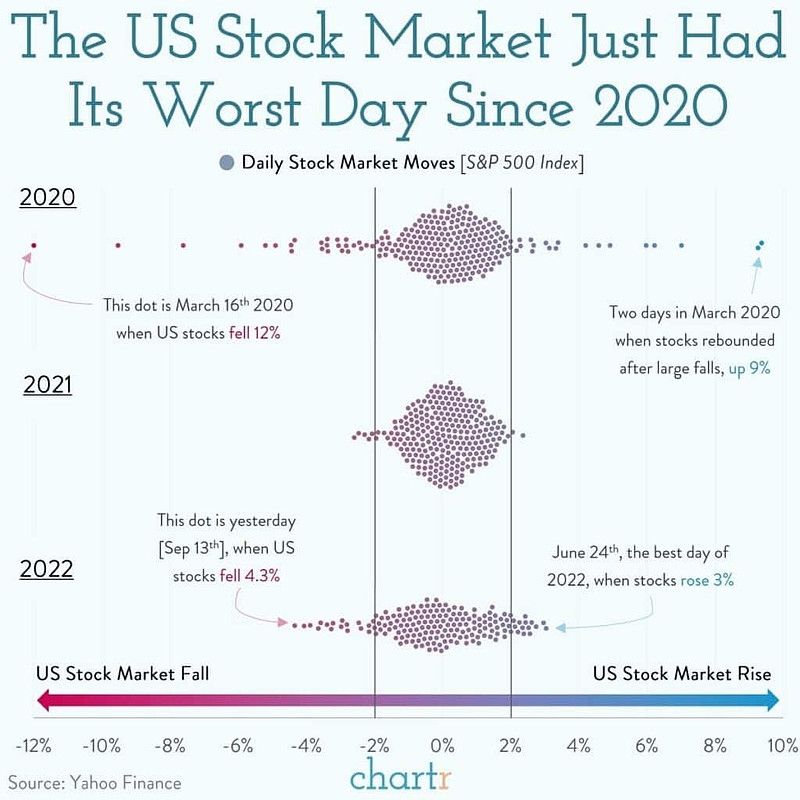

One of the key characteristics of the penny stock exchange is its volatility. Prices can fluctuate wildly in a short period of time, which can be both beneficial and detrimental. This volatility is often due to the lack of liquidity in the market, as well as the high level of speculation.

Another characteristic is the high level of risk. Since penny stocks are often associated with smaller, less established companies, they may not have the same level of financial stability or growth prospects as larger companies. This can make them more susceptible to market downturns and other negative economic factors.

Risks and Rewards

Investing in penny stocks can be lucrative, but it's important to understand the risks involved. Here are some of the key risks:

- Lack of Information: Smaller companies may not be as transparent as larger ones, making it difficult for investors to make informed decisions.

- Market Manipulation: Some penny stocks are subject to market manipulation, where unscrupulous individuals or groups try to drive up the price of the stock.

- Liquidity Issues: As mentioned earlier, penny stocks can be difficult to sell, especially if you need to exit your position quickly.

Despite these risks, the potential rewards can be substantial. For example, if a company undergoes a merger or acquisition, its stock price can skyrocket, offering significant returns to investors who held onto their shares.

Navigating the Penny Stock Exchange

To navigate the penny stock exchange effectively, it's important to do your homework. Here are some tips:

- Research Thoroughly: Before investing in a penny stock, research the company thoroughly. Look at its financial statements, management team, and business model.

- Use Reliable Sources: Stay informed by using reliable sources for financial news and analysis.

- Diversify Your Portfolio: Diversify your investments to mitigate risk. Don't put all your money into a single penny stock.

Case Study: MicroStrategy

One notable example of a company that started as a penny stock and became a significant player in the market is MicroStrategy. The company, which provides business intelligence software, was once a penny stock before experiencing significant growth. Investors who held onto their shares during this time saw substantial returns.

In conclusion, the penny stock exchange in the US offers unique opportunities for investors willing to take on the associated risks. By doing thorough research and using reliable sources, investors can make informed decisions and potentially reap the rewards of investing in these stocks.

us stock market today live cha