Understanding the Impact of Interest Rates on US Stocks

author:US stockS -

In the ever-evolving world of finance, one of the most critical factors that investors must consider is the interest rate. The Federal Reserve's decisions on interest rates can have a profound impact on the performance of US stocks. This article delves into how interest rates influence the stock market and provides insights into the potential risks and opportunities for investors.

The Relationship Between Interest Rates and Stock Market Performance

Interest rates are the cost of borrowing money and are determined by the Federal Reserve, also known as the Fed. When the Fed raises interest rates, it becomes more expensive for companies to borrow money for expansion or investment purposes. This can lead to a decrease in stock prices as investors become concerned about the potential impact on corporate earnings.

Conversely, when the Fed lowers interest rates, borrowing becomes cheaper, which can stimulate economic growth and boost stock prices. This is because lower interest rates encourage consumers and businesses to spend and invest more, leading to increased corporate earnings.

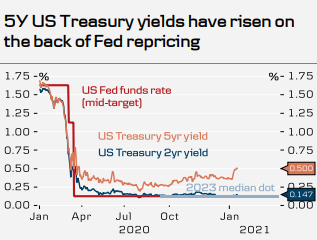

The Impact of Rising Interest Rates on US Stocks

When interest rates rise, several factors can affect the performance of US stocks:

- Bond Market Competition: Rising interest rates make existing bonds more attractive, as they offer higher yields. This can lead to a decrease in the value of stocks, as investors shift their investments from stocks to bonds.

- Earnings Pressure: Higher interest rates can increase the cost of borrowing for companies, which can put pressure on their earnings and, subsequently, their stock prices.

- Consumer Spending: Higher interest rates can lead to increased borrowing costs for consumers, which can reduce their spending power and, in turn, affect corporate earnings.

The Impact of Falling Interest Rates on US Stocks

Lower interest rates can have the opposite effect on US stocks:

- Economic Stimulus: Lower interest rates can stimulate economic growth by encouraging borrowing and spending, which can boost corporate earnings and, subsequently, stock prices.

- Stock Market Valuations: Lower interest rates can make stocks more attractive compared to fixed-income investments, leading to higher stock valuations.

- M&A Activity: Lower interest rates can make it cheaper for companies to borrow money for mergers and acquisitions, which can drive stock prices higher.

Case Studies: Interest Rates and Stock Market Performance

- 2008 Financial Crisis: The Fed lowered interest rates to nearly zero to combat the financial crisis. This move helped stabilize the stock market and stimulate economic growth.

- 2020 Pandemic: The Fed again lowered interest rates to near-zero levels to support the economy during the pandemic. This move helped mitigate the impact of the crisis on the stock market.

Conclusion

Understanding the relationship between interest rates and US stocks is crucial for investors. While rising interest rates can pose risks to stock prices, they can also create opportunities for investors who are willing to take on higher risks. By staying informed and monitoring the Fed's decisions, investors can make more informed investment decisions and navigate the complexities of the stock market.

us stock market today live cha