Understanding U.S. Stock Earnings: A Comprehensive Guide

author:US stockS -

In the world of finance, U.S. stock earnings are a cornerstone of investor decision-making. They represent the profitability of a company and can significantly impact its stock price. In this article, we'll delve into what U.S. stock earnings are, how they are reported, and how they can influence your investment strategy.

What Are U.S. Stock Earnings?

U.S. stock earnings, also known as earnings per share (EPS), are a measure of a company's profitability. It is calculated by dividing the company's net income by the number of outstanding shares. This figure is crucial for investors as it provides insight into the company's financial health and potential for growth.

How Are U.S. Stock Earnings Reported?

U.S. stock earnings are reported quarterly, with each report covering the financial performance of the company over the past three months. The report typically includes the following key figures:

- Revenue: The total amount of money a company generates from its operations.

- Net Income: The company's total income after subtracting all expenses, taxes, and interest.

- EPS: The company's earnings per share, which is a critical indicator of its profitability.

- Dividends: Any dividends paid to shareholders during the reporting period.

How Do U.S. Stock Earnings Affect Stock Prices?

U.S. stock earnings can have a significant impact on stock prices. When a company reports strong earnings, it can lead to an increase in its stock price, as investors perceive the company as more profitable and potentially more valuable. Conversely, weak earnings can lead to a decrease in the stock price.

Key Factors Influencing U.S. Stock Earnings

Several factors can influence U.S. stock earnings, including:

- Economic Conditions: The overall state of the economy can impact a company's revenue and profitability.

- Industry Trends: Changes in the industry can affect a company's competitive position and profitability.

- Company Management: Effective management can lead to increased efficiency and profitability.

- Product Innovation: New products or services can drive revenue growth and improve earnings.

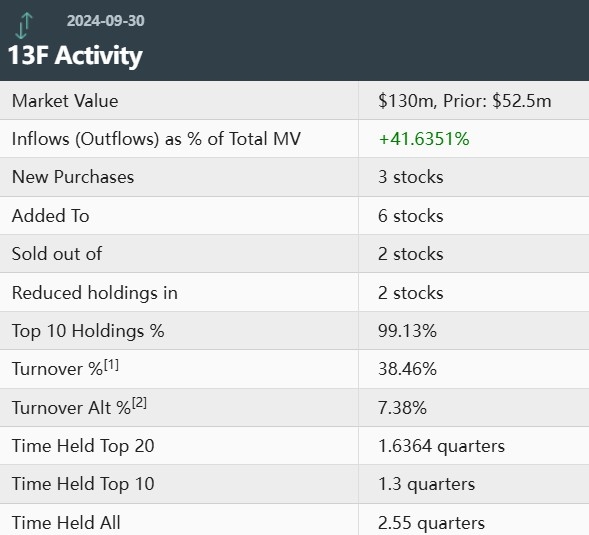

Case Study: Apple Inc.

One notable example of U.S. stock earnings is Apple Inc. Over the years, Apple has consistently reported strong earnings, driven by its innovative products and strong brand. In its most recent quarterly report, Apple reported revenue of

Conclusion

Understanding U.S. stock earnings is crucial for investors looking to make informed decisions. By analyzing a company's earnings report, investors can gain insight into its financial health and potential for growth. Whether you're a seasoned investor or just starting out, paying close attention to U.S. stock earnings can help you make more informed investment choices.

us stock market today live cha