Trump Tariffs Impact on US Stock Market in 2025

author:US stockS -

As we delve into 2025, the echoes of former President Donald Trump's tariffs on imported goods still resonate through the American economy. These tariffs, implemented to bolster American industries and workers, had a significant impact on the stock market. This article explores the lingering effects of Trump's tariffs on the US stock market in 2025.

Understanding the Tariffs

Donald Trump's administration imposed tariffs on a wide range of imported goods, primarily from China. The aim was to reduce the trade deficit and protect American industries. However, the tariffs also led to increased costs for consumers and businesses, and sparked trade disputes with other countries.

Impact on the Stock Market

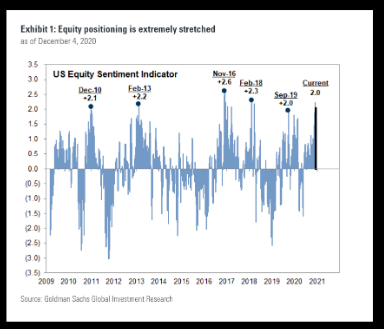

The impact of Trump's tariffs on the stock market was multifaceted. Initially, investors were optimistic about the potential benefits of these tariffs, leading to a surge in the stock market. However, as the effects of the tariffs became more pronounced, the stock market began to take a hit.

Increased Costs and Lower Profits

The tariffs led to increased costs for businesses importing goods from China. These increased costs were passed on to consumers, leading to higher prices for a range of goods and services. As a result, businesses faced lower profits, which were reflected in their stock prices.

Trade Disputes and Uncertainty

The tariffs also led to trade disputes with China and other countries, creating uncertainty in the global economy. This uncertainty made investors more cautious, leading to a sell-off in the stock market.

Sector-Specific Impacts

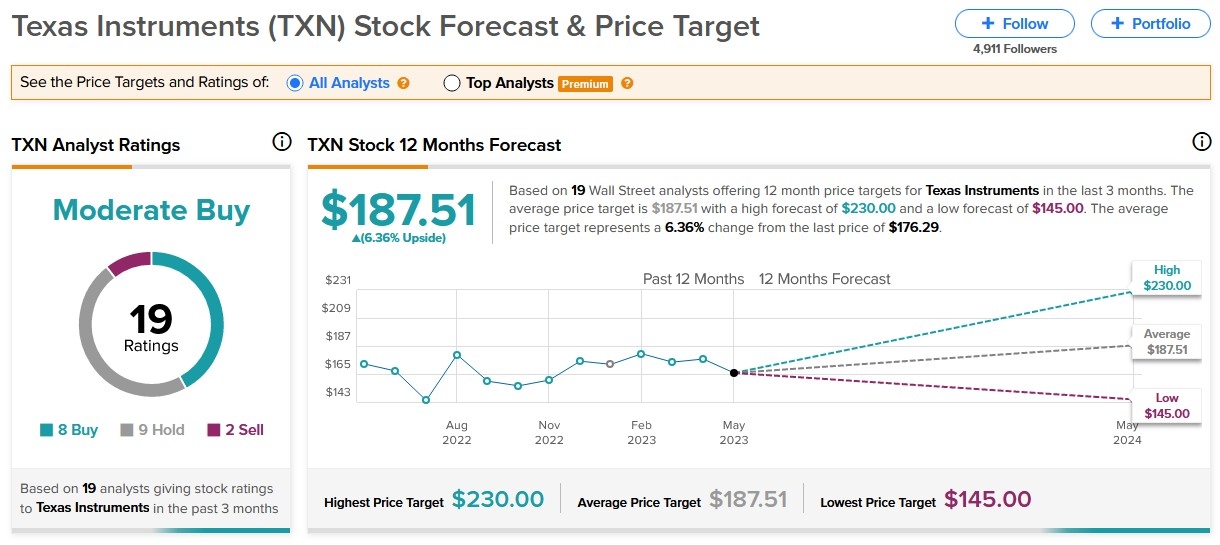

The impact of the tariffs was not uniform across all sectors. Industries heavily reliant on imports from China, such as technology and consumer goods, were particularly affected. The stock prices of these companies fell as the tariffs took effect.

Case Studies

One notable example is the technology giant Apple. Apple relies heavily on Chinese manufacturers for its products. The tariffs led to increased production costs for Apple, which were passed on to consumers. As a result, Apple's stock price fell significantly in the months following the implementation of the tariffs.

Another example is the auto industry. The tariffs led to increased costs for car manufacturers, which were unable to pass on these costs to consumers. This led to lower profits and falling stock prices for automakers.

Conclusion

In conclusion, Trump's tariffs had a significant impact on the US stock market in 2025. The increased costs and trade disputes created uncertainty and lowered profits for businesses, leading to a sell-off in the stock market. While the full impact of the tariffs is still unfolding, it is clear that their effects will be felt for years to come.

us stock market today live cha