Trading US Stocks from Overseas: A Comprehensive Guide

author:US stockS -

Introduction

Investing in the United States stock market from overseas can be a lucrative opportunity for investors worldwide. With the rise of digital technology and financial platforms, it has become increasingly accessible for international investors to trade US stocks. However, navigating the complexities of this process requires careful planning and knowledge. In this article, we will explore the steps and considerations involved in trading US stocks from overseas, providing you with a comprehensive guide to help you make informed decisions.

Understanding the US Stock Market

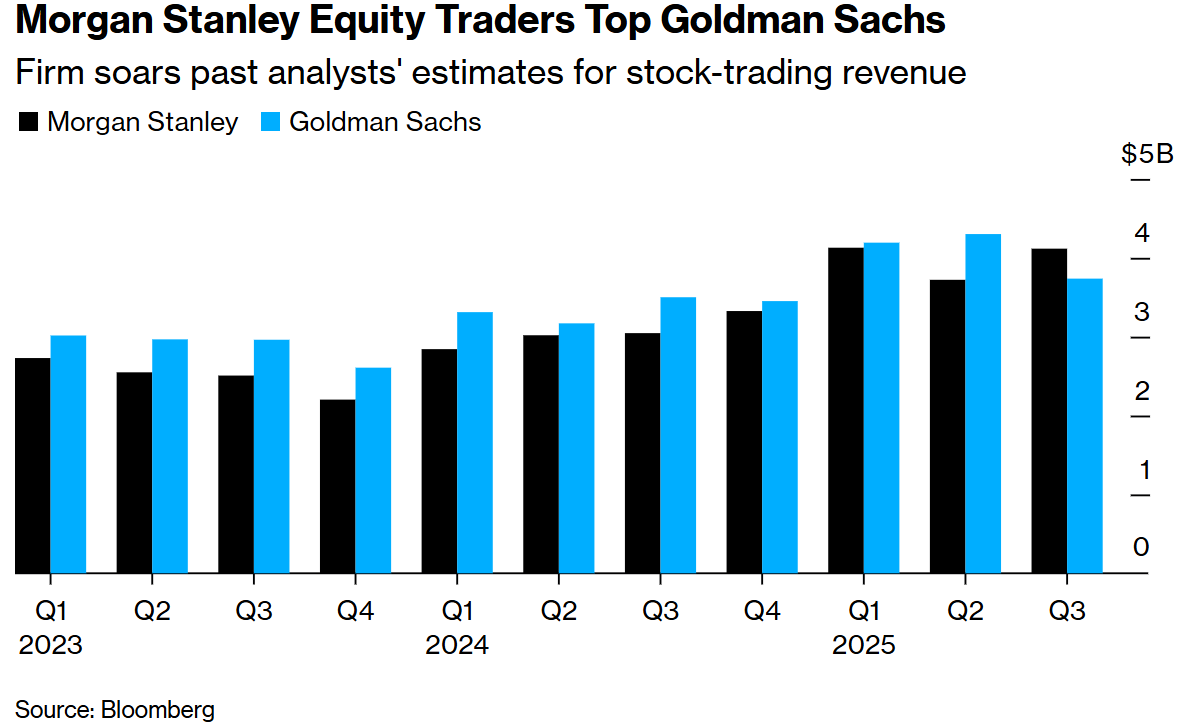

The US stock market is one of the largest and most liquid in the world, with a wide range of companies listed on major exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ. It offers a diverse selection of investment opportunities across various sectors, including technology, healthcare, finance, and consumer goods.

Eligibility and Requirements

To trade US stocks from overseas, you must first ensure that you meet the eligibility criteria. Most brokers require international investors to have a valid passport and proof of residence in their home country. Additionally, you may need to provide additional documentation, such as a tax identification number or a financial statement.

Choosing a Broker

Selecting the right broker is crucial for a successful trading experience. Look for a reputable broker that offers competitive fees, easy-to-use platforms, and reliable customer support. Some popular brokers for international investors include E*TRADE, TD Ameritrade, and Charles Schwab.

Opening an Account

Once you have chosen a broker, you will need to open an account. This process typically involves filling out an application form, providing identification and residency documentation, and depositing funds into your account. Be sure to carefully review the broker's terms and conditions before proceeding.

Understanding Exchange Rates and Fees

When trading US stocks from overseas, you will need to consider the impact of exchange rates and fees. Exchange rate fluctuations can affect the value of your investments, while brokerage fees can vary depending on the broker and the type of trade. It's important to understand these factors and factor them into your investment strategy.

Research and Analysis

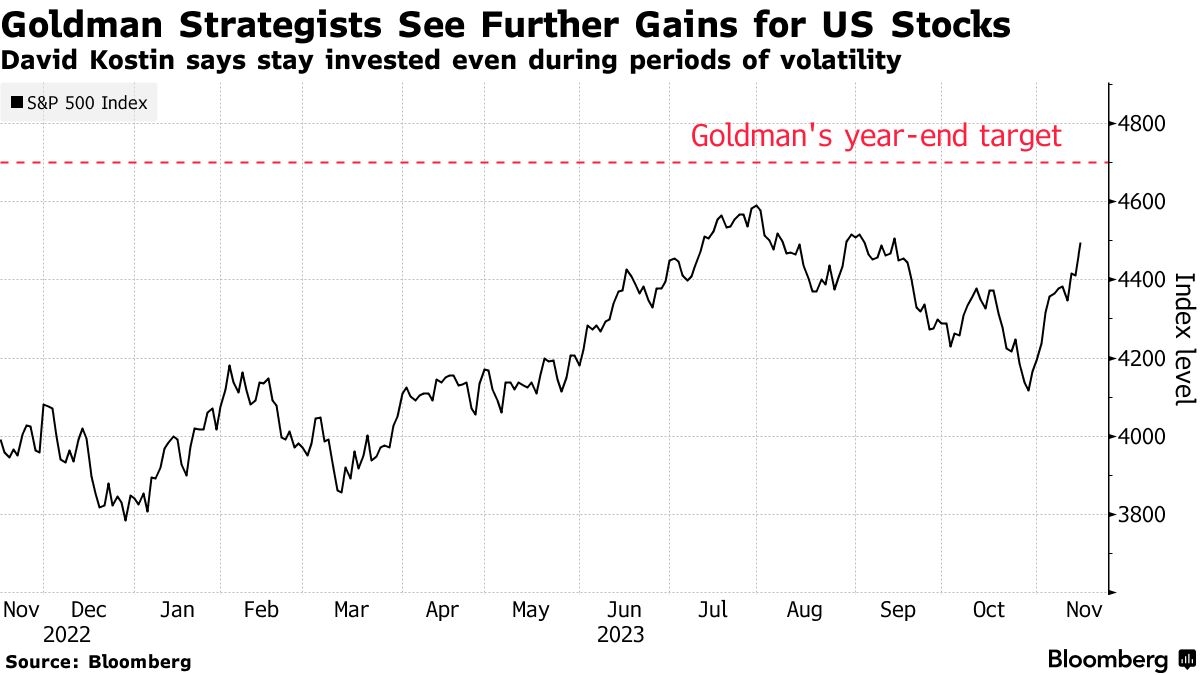

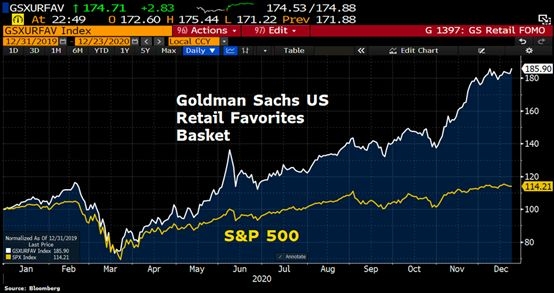

Successful trading requires thorough research and analysis. Utilize financial news websites, stock market data, and investment tools to stay informed about market trends and individual company performance. Consider using technical and fundamental analysis to identify potential investment opportunities.

Case Study: Investing in US Tech Stocks

Let's consider a hypothetical scenario where an international investor decides to invest in US tech stocks. After conducting thorough research, the investor identifies a promising tech company with strong growth prospects. By carefully analyzing the company's financials, market trends, and industry competition, the investor decides to purchase shares. Over time, the stock appreciates, and the investor sells their shares for a profit.

Conclusion

Trading US stocks from overseas can be a rewarding investment opportunity for international investors. By understanding the process, choosing the right broker, and conducting thorough research, you can navigate the complexities of the US stock market and potentially achieve significant returns. Remember to stay informed, manage your risks, and consult with a financial advisor if needed.

us stock market today live cha