Stocks Momentum US: Unveiling the Power of Market Trends

author:US stockS -

In the fast-paced world of finance, understanding the stocks momentum US can be the key to unlocking significant returns. This article delves into the concept of stock momentum, its importance in the American market, and how investors can leverage this powerful tool to make informed decisions.

What is Stocks Momentum?

Stock momentum refers to the rate at which a stock price is moving. It is a measure of the speed at which a stock is gaining or losing value. When a stock is said to have momentum, it means that it is on an upward or downward trend, and investors often look to capitalize on this trend.

Why is Stocks Momentum Important in the US Market?

The US stock market is one of the most dynamic and influential markets in the world. Understanding stocks momentum US can help investors identify potential opportunities and avoid potential pitfalls.

Market Trends: Stock momentum is a critical indicator of market trends. By analyzing momentum, investors can identify which stocks are performing well and which are not.

Risk Management: Stock momentum can help investors manage risk. By investing in stocks with positive momentum, investors can reduce the likelihood of losses.

Profit Potential: Stocks with strong momentum have the potential to deliver significant returns. Investors who can identify these stocks early can capitalize on this potential.

Leveraging Stocks Momentum US

To leverage stocks momentum US, investors need to follow a systematic approach:

Research: Conduct thorough research to identify stocks with strong momentum. This involves analyzing historical price data, volume, and other relevant metrics.

Technical Analysis: Use technical analysis tools, such as moving averages and relative strength indices, to identify stocks with positive momentum.

Diversification: Diversify your portfolio to mitigate risk. By investing in a variety of stocks with different momentum, you can reduce the impact of any single stock's performance.

Monitor Trends: Continuously monitor the momentum of your investments. If a stock's momentum changes, it may be time to adjust your strategy.

Case Studies

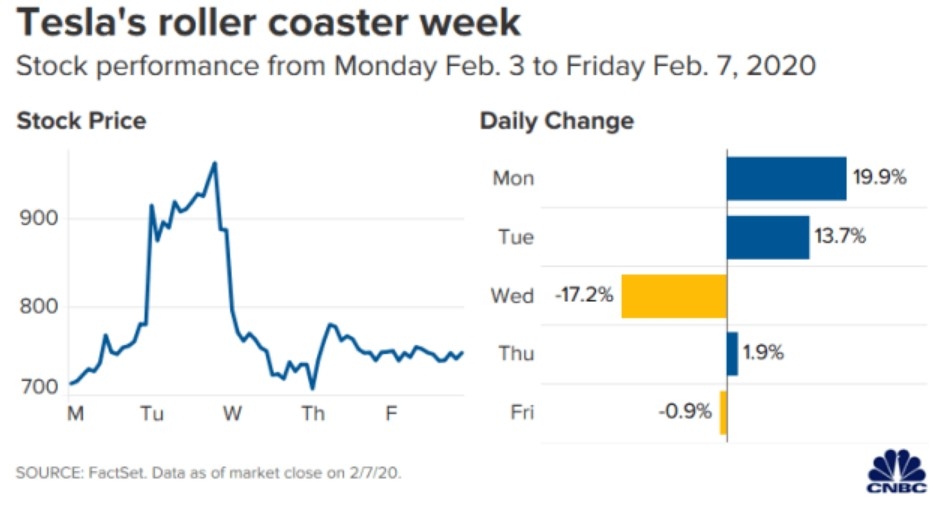

To illustrate the power of stocks momentum US, let's consider two case studies:

Apple Inc. (AAPL): In the past few years, Apple has consistently shown strong momentum. Investors who identified this trend early and invested in AAPL have seen significant returns.

Tesla Inc. (TSLA): Similarly, Tesla has experienced strong momentum, particularly in recent years. Investors who capitalized on this trend have seen substantial gains.

Conclusion

Understanding stocks momentum US is crucial for investors looking to succeed in the dynamic American stock market. By following a systematic approach and staying informed, investors can leverage momentum to make informed decisions and potentially achieve significant returns.

us stock market today live cha