September 2025 US Stock Market Summary

author:US stockS -

Introduction

As we delve into the second half of the year, it's essential to look back and reflect on the performance of the US stock market during the month of September 2025. The market, often a reflection of the broader economic trends, saw several ups and downs throughout the month. In this summary, we will explore the key highlights, significant shifts, and major sectors that dominated the September 2025 US stock market landscape.

Market Performance Overview

September 2025 was a mixed month for the US stock market. While the S&P 500 saw a modest increase of 2.5%, the NASDAQ Composite struggled to maintain its momentum, ending the month down by 1.3%. This discrepancy can be attributed to several factors, including sector-specific performance and broader economic concerns.

Sector Analysis

1. Technology Sector

The technology sector, traditionally a leader in the stock market, faced headwinds during September. With companies like Apple, Amazon, and Google experiencing a decline in stock prices, investors began to question the sector's future growth potential. Key concerns included rising interest rates, global supply chain disruptions, and regulatory challenges.

2. Healthcare Sector

On the flip side, the healthcare sector emerged as a bright spot. Firms such as Johnson & Johnson, Merck, and Pfizer saw their stock prices rise due to positive vaccine news, drug approvals, and increasing demand for medical devices. The healthcare sector's performance underscored the importance of investing in industries that are less affected by economic downturns.

3. Financial Sector

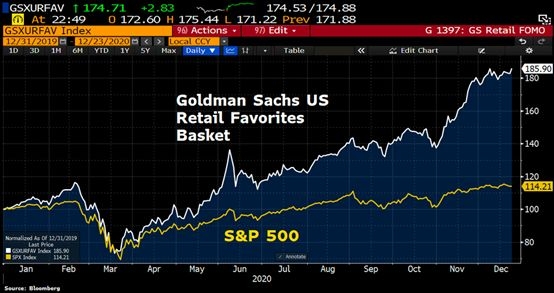

The financial sector experienced a mixed performance, with bank stocks leading the pack. Companies like JPMorgan Chase and Goldman Sachs saw their shares increase as the market expected a rise in interest rates and increased corporate lending activity. However, some investors remained cautious due to concerns about rising inflation and a potential recession.

4. Energy Sector

The energy sector was another significant performer, with companies like ExxonMobil and Chevron witnessing a surge in their stock prices. This growth was attributed to rising oil prices and strong demand from emerging markets.

Key Highlights and Trends

Several key highlights and trends stood out in the September 2025 US stock market:

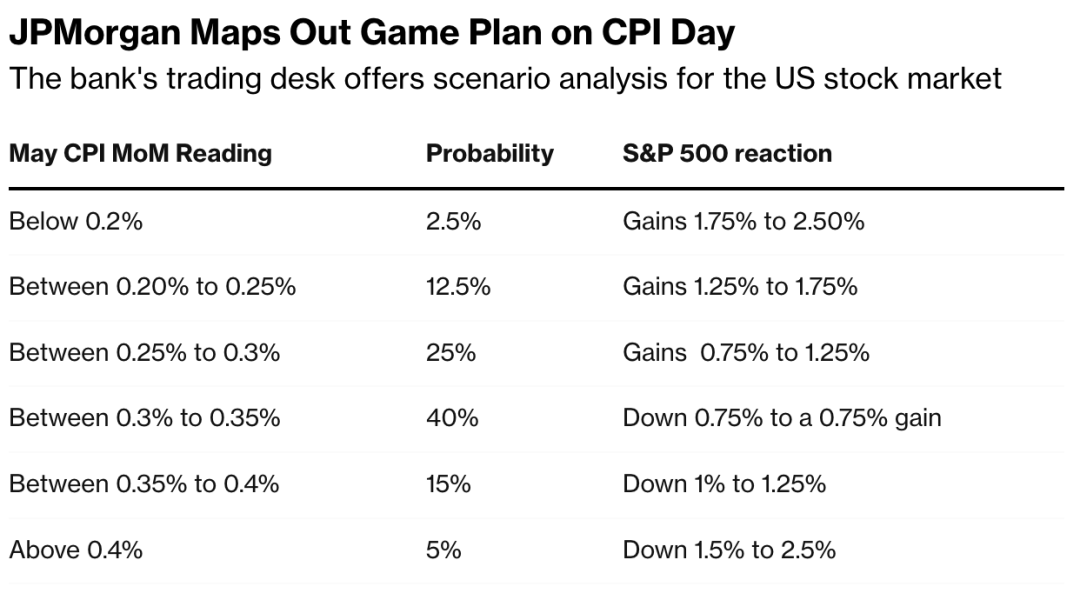

- Rising Inflation: Inflation continued to be a major concern, with the Consumer Price Index (CPI) rising by 0.6% in September. This increase led to speculation about further interest rate hikes from the Federal Reserve.

- Interest Rates: The Federal Reserve raised interest rates by 0.25% in September, marking the seventh increase this year. This move aimed to control inflation and maintain the economic stability of the country.

- Geopolitical Tensions: Geopolitical tensions between the US and China continued to affect investor sentiment. Stocks in companies with significant exposure to the Chinese market saw volatility and a downward trend.

Case Studies

Several case studies illustrate the performance of specific stocks during September 2025:

- Tesla Inc.: The electric vehicle manufacturer's stock price plummeted by 8% during September due to concerns about its global supply chain and production delays.

- Nike Inc.: Despite a modest 1.2% decline in the month, Nike's stock maintained its strong position due to increasing demand for its products in both the US and international markets.

- Walmart Inc.: The retail giant's stock saw a significant rise of 4% in September, attributed to its robust performance during the holiday season and growing e-commerce presence.

Conclusion

In summary, the September 2025 US stock market presented a mix of challenges and opportunities. Investors navigated rising inflation, geopolitical tensions, and shifting sector dynamics. As we move forward, it's essential to stay informed and adapt to the changing landscape to make informed investment decisions.

us stock market today live cha