Quarterly Paying US Stocks: A Smart Investment Strategy

author:US stockS -

Are you looking to invest in U.S. stocks that offer quarterly dividends? If so, you're in luck! Quarterly paying stocks can be a smart investment strategy, providing investors with regular income and the potential for long-term growth. In this article, we'll explore the benefits of investing in quarterly paying U.S. stocks, discuss the best sectors to consider, and provide a few examples of companies that fit the bill.

Understanding Quarterly Paying Stocks

Quarterly paying stocks are companies that distribute dividends to their shareholders on a quarterly basis. This means investors can expect to receive dividends four times a year, typically in March, June, September, and December. These dividends can be a significant source of income for investors, especially those relying on investment income to supplement their retirement or other financial goals.

Benefits of Investing in Quarterly Paying Stocks

Investing in quarterly paying stocks offers several benefits:

- Regular Income: As mentioned, quarterly dividends provide a steady stream of income for investors.

- Potential for Growth: Many companies that pay quarterly dividends also have a history of increasing their dividends over time, which can lead to significant long-term returns.

- Diversification: Investing in a variety of quarterly paying stocks can help diversify your portfolio and reduce risk.

Best Sectors for Quarterly Paying Stocks

Several sectors are known for having companies that pay quarterly dividends. Here are a few to consider:

- Utilities: Utilities companies, such as electric, gas, and water providers, are known for their stable and predictable cash flows, making them popular dividend-paying stocks.

- Consumer Staples: Companies in the consumer staples sector, such as food and beverage, household goods, and personal care products, often pay quarterly dividends due to their stable and resilient business models.

- Healthcare: The healthcare sector includes pharmaceutical companies, biotech firms, and medical device manufacturers, all of which can offer quarterly dividends.

Examples of Quarterly Paying U.S. Stocks

Here are a few examples of U.S. stocks that pay quarterly dividends:

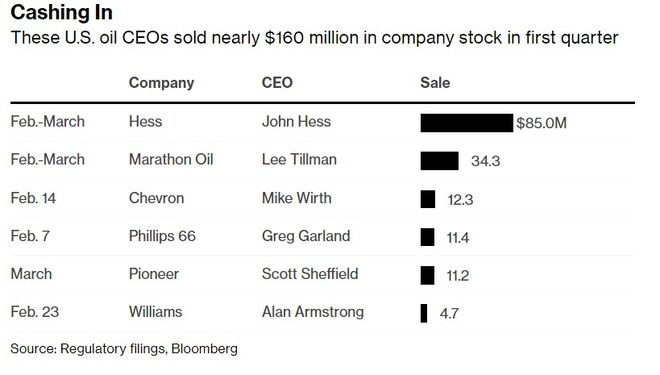

- Exxon Mobil Corporation (XOM): As one of the world's largest oil and gas companies, Exxon Mobil has a long history of paying quarterly dividends and increasing them over time.

- Procter & Gamble Company (PG): This consumer goods giant has paid quarterly dividends for over a century and has a strong track record of increasing its dividends annually.

- Johnson & Johnson (JNJ): This diversified healthcare company offers quarterly dividends and has a history of increasing its dividends for over 60 years.

Conclusion

Investing in quarterly paying U.S. stocks can be a smart strategy for generating regular income and achieving long-term growth. By focusing on stable sectors and companies with a history of increasing dividends, investors can create a diversified portfolio that provides both income and potential capital appreciation.

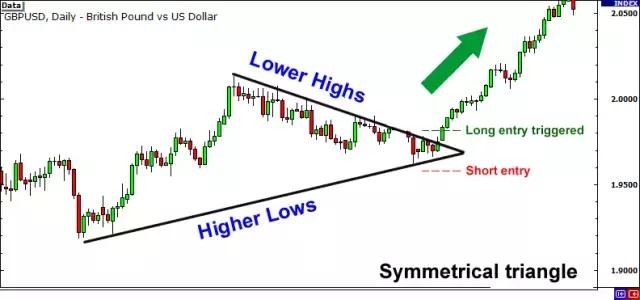

us stock market today live cha