Mars, Inc. Stock Price: A Comprehensive Analysis

author:US stockS -

In the ever-evolving world of consumer goods, Mars, Inc. stands as a powerhouse in the food and beverage industry. The company's stock has been a topic of interest for investors and industry watchers alike. This article delves into the factors influencing Mars, Inc.'s stock price, providing a comprehensive analysis of its performance over the years.

Understanding Mars, Inc.

Mars, Inc. is a global manufacturer of confectionery, pet food, and other food products. Some of its well-known brands include M&M's, Snickers, Milky Way, Pedigree, and Whiskas. The company has a long-standing history, dating back to 1911, and has grown to become one of the largest privately-owned companies in the world.

Market Performance

The stock price of Mars, Inc. has seen its fair share of ups and downs over the years. Several factors have contributed to its performance, including market trends, economic conditions, and company-specific developments.

Market Trends

One of the primary factors influencing Mars, Inc.'s stock price is market trends. The company's success is closely tied to consumer preferences and global demand for its products. For instance, the growing popularity of health-conscious eating habits has impacted the sales of some of its confectionery products, while the demand for pet food has remained strong.

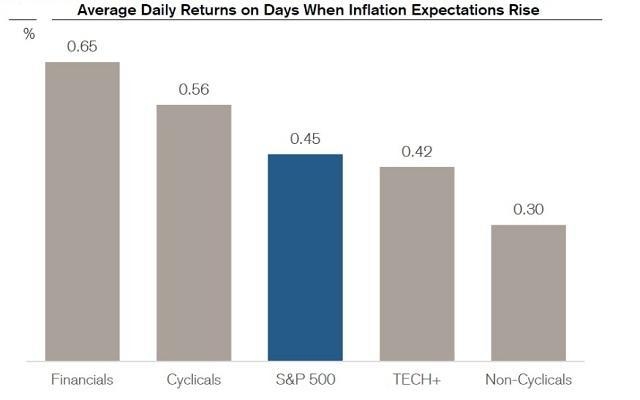

Economic Conditions

Economic conditions also play a significant role in the stock price of Mars, Inc. During periods of economic growth, consumer spending tends to increase, benefiting the company's revenue. Conversely, during economic downturns, consumers may cut back on non-essential purchases, negatively impacting the company's performance.

Company-Specific Developments

Mars, Inc. has also experienced various company-specific developments that have influenced its stock price. These include strategic investments, acquisitions, and product launches. For example, the company's acquisition of Wrigley in 2008 significantly expanded its presence in the confectionery market.

Case Study: Mars, Inc.'s Acquisition of Wrigley

In 2008, Mars, Inc. acquired Wrigley, a leading manufacturer of chewing gum and other confectionery products. This acquisition was a strategic move to strengthen Mars, Inc.'s position in the confectionery market and diversify its product portfolio. The acquisition was completed at a cost of $23 billion, and it has since proven to be a successful venture for the company.

Conclusion

In conclusion, the stock price of Mars, Inc. is influenced by a variety of factors, including market trends, economic conditions, and company-specific developments. By understanding these factors, investors can gain valuable insights into the company's future performance and make informed investment decisions.

us stock market today live cha