How to Invest in US Stocks for Beginners

author:US stockS -

Embarking on the journey of investing in US stocks can be daunting for beginners. However, with the right knowledge and approach, you can start building a solid investment portfolio. This guide will walk you through the essential steps to get you started on investing in US stocks.

Understanding the Basics

Firstly, it’s crucial to understand the basics of the stock market. Stocks represent ownership in a company. When you buy a stock, you are purchasing a small piece of that company. The value of your investment can increase if the company performs well, and decrease if it performs poorly.

1. Educate Yourself

Before diving into the stock market, educate yourself about how it works. Understand the different types of stocks, such as common and preferred, and learn about the factors that can influence stock prices. Some valuable resources include online courses, books, and websites dedicated to financial education.

2. Set Your Goals

Define your investment goals. Are you looking for long-term growth, income, or both? Your goals will determine your investment strategy and the types of stocks you should consider.

3. Choose a Broker

Select a reputable online brokerage firm to open an account. Some popular options include E*TRADE, TD Ameritrade, and Fidelity. Look for a broker that offers low fees, a user-friendly platform, and access to the types of stocks you want to invest in.

4. Open an Account

To open an account, you’ll need to provide personal information, including your name, address, Social Security number, and bank account details. You may also need to complete a questionnaire to assess your investment knowledge and risk tolerance.

5. Research and Analyze Stocks

Start by researching companies that align with your investment goals. Look for companies with strong fundamentals, such as a good track record of earnings growth, solid financials, and a strong market position. Tools like financial ratios, price-to-earnings (P/E) ratios, and market capitalization can help you evaluate a company’s potential.

6. Diversify Your Portfolio

Diversification is key to managing risk. Don’t put all your money into one stock or one sector. Instead, spread your investments across different companies and industries. Consider using a mix of stocks, bonds, and other assets to further diversify your portfolio.

7. Start Small and Build Over Time

If you’re new to investing, start with a small amount of money and gradually increase your investment as you become more comfortable. This approach allows you to learn from your mistakes without risking too much capital.

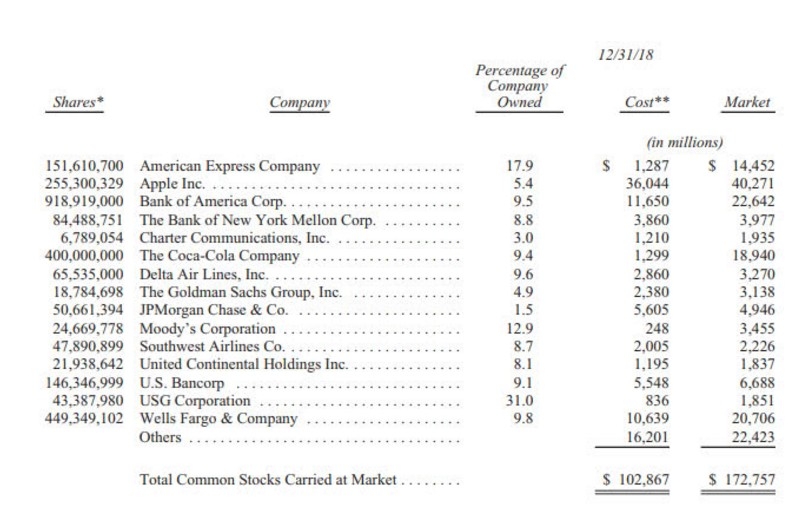

Case Study: Apple Inc. (AAPL)

To illustrate the process, let’s take a look at Apple Inc. (AAPL). As of 2021, Apple is one of the world’s largest and most valuable companies. With a market capitalization of over $2 trillion, it has a strong track record of earnings growth and innovation.

If you believe that Apple will continue to grow, you might consider investing in its stock. Before making a decision, research the company’s financials, competitive position, and market trends. You may also want to look at the stock’s price-to-earnings (P/E) ratio, which, as of 2021, was around 29. This indicates that the stock is trading at a premium compared to its earnings.

Remember, past performance is not indicative of future results. Always do your due diligence before investing.

Conclusion

Investing in US stocks can be a rewarding experience if you approach it with the right mindset and strategy. By educating yourself, setting clear goals, choosing the right broker, and diversifying your portfolio, you can start building a strong investment foundation. Keep in mind that investing involves risk, and it’s essential to do your research and stay informed.

us stock market today live cha