How Would US Stocks Dollar Collapse?

author:US stockS -

The collapse of the US dollar and the subsequent impact on the stock market is a topic that has been widely discussed in financial circles. This article aims to explore the potential causes and consequences of such a scenario, providing insights into the factors that could lead to a dollar collapse and its implications for the stock market.

Understanding the US Dollar's Role

The US dollar is the world's primary reserve currency, playing a crucial role in global trade and finance. Its stability is essential for the smooth functioning of the global economy. However, several factors could lead to a collapse in the value of the dollar, potentially triggering a ripple effect across the stock market.

Factors Leading to a Dollar Collapse

Economic Deterioration: A significant economic downturn in the United States could lead to a collapse in the dollar. Factors such as high inflation, rising unemployment, and a decrease in consumer spending can weaken the economy and erode the dollar's value.

Political Instability: Political instability, such as a government shutdown or a political crisis, can create uncertainty and lead to a loss of confidence in the US dollar. Investors may seek alternative currencies, causing the dollar to weaken.

Trade Wars: Escalating trade tensions, particularly with major trading partners like China, can lead to a decrease in global trade and a decline in the dollar's value. The US dollar is often considered a safe haven during times of economic uncertainty, but trade wars can undermine this perception.

Interest Rate Cuts: The Federal Reserve's decision to cut interest rates can weaken the dollar. Lower interest rates make US assets less attractive to foreign investors, leading to a decrease in demand for the dollar.

Implications for the Stock Market

A collapse in the US dollar could have significant implications for the stock market:

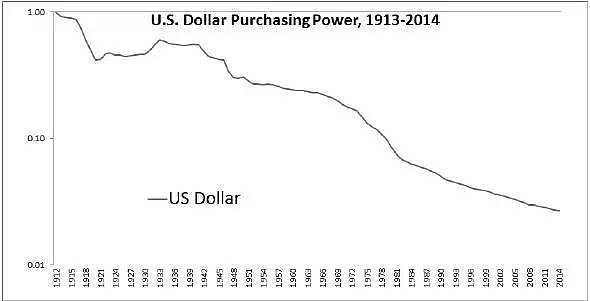

Inflation: A weaker dollar can lead to higher inflation, as imported goods become more expensive. This can erode the purchasing power of investors and negatively impact stock prices.

Currency Risk: Companies with significant exposure to international markets may face currency risk if the dollar weakens. This can lead to lower profits and a decrease in stock prices.

Market Volatility: A collapse in the dollar can lead to increased market volatility, as investors react to the changing economic landscape. This can create uncertainty and lead to a sell-off in the stock market.

Case Study: The 2008 Financial Crisis

One notable example of the impact of a collapsing dollar on the stock market is the 2008 financial crisis. The US dollar weakened significantly during this period, leading to higher inflation and market volatility. The stock market experienced a significant decline, with the S&P 500 falling by nearly 50% from its peak in October 2007 to its trough in March 2009.

Conclusion

The potential collapse of the US dollar and its impact on the stock market is a complex issue with numerous factors at play. While it is difficult to predict the exact outcome, understanding the potential risks and consequences can help investors make informed decisions. As the global economy continues to evolve, it is crucial to stay informed and prepared for any potential challenges that may arise.

us stock market today live cha