How Many US Retirees Have Stocks?

author:US stockS -

Introduction: As the population ages, understanding the financial strategies of retirees becomes increasingly important. One key area of interest is the role of stocks in their retirement portfolios. This article delves into the prevalence of stock ownership among US retirees, offering insights into the significance of this financial asset class for their retirement savings.

The Importance of Stock Ownership in Retirement Portfolios

Stocks have long been considered a crucial component of a diversified retirement portfolio. They offer potential for long-term growth and income, making them attractive for retirees seeking to maintain their purchasing power. According to a survey by the Employee Benefit Research Institute (EBRI), approximately 56% of US retirees have stocks in their retirement portfolios. This percentage includes stocks held directly, as well as through mutual funds, ETFs, and other investment vehicles.

Why Retirees Choose Stocks

Several factors contribute to the popularity of stocks among retirees:

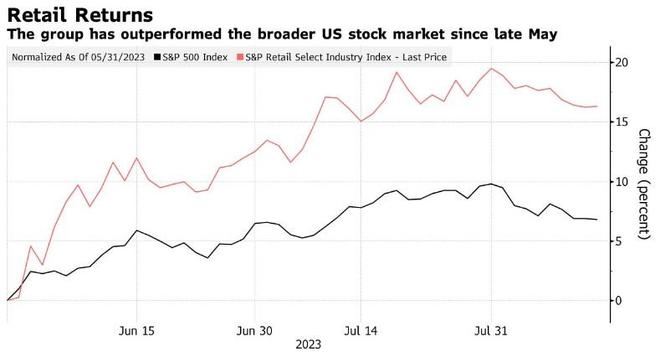

- Potential for Growth: Stocks have historically outperformed other investment classes over the long term, offering the potential for capital appreciation.

- Income Generation: Dividends from stocks can provide a source of regular income for retirees.

- Inflation Protection: Stocks often provide better protection against inflation compared to fixed-income investments.

The Diversification Factor

Retirees who own stocks often do so as part of a diversified investment strategy. Diversification helps to mitigate risk by spreading investments across various asset classes. Research indicates that including stocks in a diversified portfolio can lead to improved risk-adjusted returns over time.

Case Study: Jane's Retirement Portfolio

Consider Jane, a 65-year-old retiree who owns stocks as part of her retirement portfolio. Jane has allocated approximately 40% of her portfolio to stocks, with the remainder in bonds, real estate, and cash. This diversified approach has allowed her to benefit from the potential growth of stocks while also providing a cushion against market volatility.

Conclusion

The prevalence of stock ownership among US retirees underscores the importance of this investment class in their retirement savings. With the potential for growth, income generation, and inflation protection, stocks remain a vital component of a well-diversified retirement portfolio. As the population ages, understanding the role of stocks in retirement planning will become even more critical for both retirees and financial advisors.

us stock market today live cha