How Are US Stock Markets Performing in 2023?

author:US stockS -

The US stock markets have been a hot topic of discussion in recent years, and for good reason. With the rise of digital technology and globalization, the stock market has become a crucial indicator of the country's economic health. In this article, we will explore the current state of the US stock markets, including recent trends, factors affecting their performance, and potential future outlook.

Recent Trends

The US stock markets have experienced significant growth over the past few years. According to the Wall Street Journal, the S&P 500 index has seen a 20% increase since the beginning of 2021. This growth can be attributed to various factors, including strong corporate earnings, low interest rates, and a recovering economy.

However, the markets have also faced challenges. The COVID-19 pandemic has caused volatility and uncertainty, leading to wild swings in stock prices. The 纳斯达克指数 has experienced particularly wild swings, with the index rising to record highs and then falling sharply in a matter of weeks.

Factors Affecting Stock Market Performance

Several factors have contributed to the performance of the US stock markets. Here are some of the key factors:

- Economic Growth: Strong economic growth has led to higher corporate earnings, which in turn has driven stock prices up.

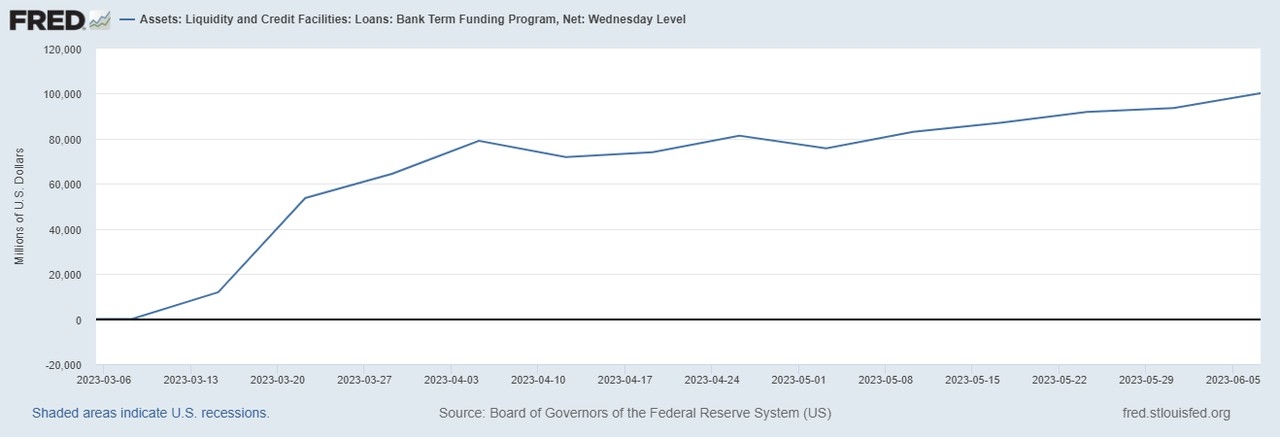

- Low Interest Rates: The Federal Reserve has kept interest rates low, making borrowing cheaper and encouraging investors to invest in stocks.

- Corporate Earnings: Companies have reported strong earnings, which has boosted investor confidence.

- Technological Advancements: The rise of technology has led to increased innovation and growth in certain sectors, such as technology and healthcare.

- Globalization: The increasing interconnectedness of the global economy has opened up new opportunities for US companies, leading to higher profits.

Potential Future Outlook

While the US stock markets have performed well in recent years, there are concerns about the future. Here are some potential risks:

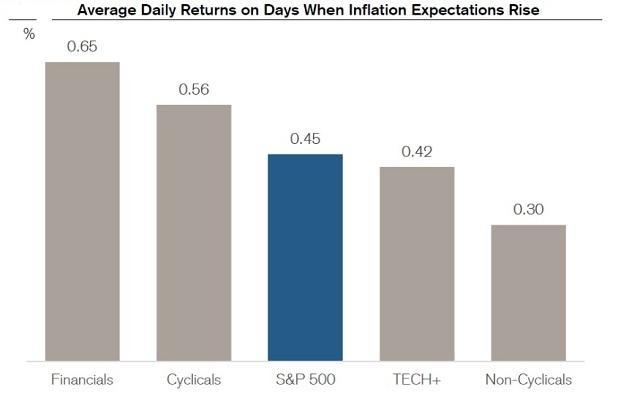

- Inflation: The Federal Reserve has been raising interest rates to combat inflation, which could lead to higher borrowing costs and slower economic growth.

- Political Uncertainty: The midterm elections and other political events could lead to uncertainty and volatility in the markets.

- Economic Slowdown: A potential economic slowdown could lead to lower corporate earnings and a decline in stock prices.

Case Studies

To illustrate the impact of various factors on the stock markets, let's look at a few case studies:

- Tesla (TSLA): Tesla has seen significant growth in its stock price, largely due to its innovative technology and strong demand for electric vehicles. However, the company has also faced challenges, such as production delays and regulatory scrutiny.

- Amazon (AMZN): Amazon has been a leader in the e-commerce industry, driving growth in the stock market. However, the company has also faced criticism for its labor practices and environmental impact.

- Moderna (MRNA): Moderna's stock price skyrocketed after the company developed a successful COVID-19 vaccine. However, the stock has since fallen as investors reassess the company's long-term prospects.

In conclusion, the US stock markets have experienced significant growth in recent years, driven by factors such as economic growth, low interest rates, and technological advancements. However, there are concerns about the future, including inflation, political uncertainty, and potential economic slowdowns. As investors, it is crucial to stay informed and consider the risks and opportunities in the stock market.

us stock market today live cha