HSBC Stock Price US: A Comprehensive Analysis

author:US stockS -

In the ever-evolving world of finance, staying updated with stock prices is crucial for investors. One such stock that has caught the attention of many is HSBC. This article delves into the current HSBC stock price US and offers a comprehensive analysis of its performance and potential future trends.

Understanding HSBC Stock Price US

HSBC Holdings plc, also known as the Hongkong and Shanghai Banking Corporation, is one of the largest banking and financial services organizations in the world. The stock is listed on the London Stock Exchange and the Hong Kong Stock Exchange, and it is also traded on the New York Stock Exchange under the ticker symbol "HSBC."

The HSBC stock price US has been fluctuating over the years, reflecting the company's performance and the broader market conditions. As of the latest data, the stock is trading at approximately $29.50 per share. However, it is important to note that stock prices can change rapidly due to various factors.

Factors Influencing HSBC Stock Price US

Several factors influence the HSBC stock price US, including:

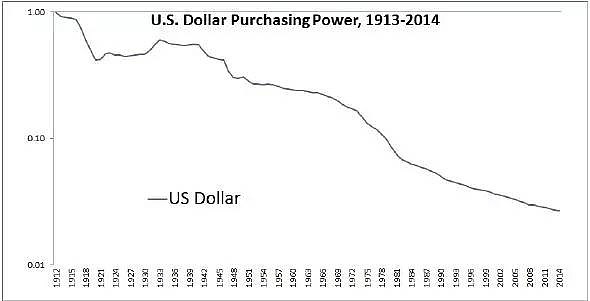

- Economic Conditions: Economic stability and growth play a significant role in determining the stock price. During periods of economic downturn, stock prices tend to fall, while economic growth can lead to an increase in stock prices.

- Company Performance: The financial performance of HSBC, including its revenue, profits, and growth prospects, directly impacts the stock price. Positive financial results can lead to an increase in stock prices, while negative results can cause them to fall.

- Market Sentiment: The overall sentiment of the market towards HSBC can also influence its stock price. Factors such as political instability, regulatory changes, and industry trends can affect market sentiment.

Recent Performance of HSBC

In recent years, HSBC has faced various challenges, including economic uncertainty and regulatory scrutiny. However, the company has managed to maintain a strong presence in the global banking industry. In the last fiscal year, HSBC reported a net profit of $14.9 billion, a significant increase from the previous year.

The company's strong performance can be attributed to several factors, including:

- Growth in Asia: HSBC has been focusing on expanding its operations in Asia, which has contributed to its overall growth.

- Cost Reduction: The company has implemented various cost-cutting measures, which have helped improve its profitability.

- Digital Transformation: HSBC has been investing in digital transformation initiatives, which have helped enhance its customer experience and operational efficiency.

Potential Future Trends for HSBC Stock Price US

Looking ahead, several factors could impact the future performance of HSBC and, consequently, the HSBC stock price US:

- Economic Growth: If the global economy continues to grow, it could lead to an increase in HSBC's revenue and profits, potentially driving up the stock price.

- Regulatory Changes: Changes in regulations, particularly in the banking industry, could impact HSBC's operations and profitability.

- Competition: The banking industry is highly competitive, and increased competition could affect HSBC's market share and profitability.

Conclusion

The HSBC stock price US has been influenced by various factors, including economic conditions, company performance, and market sentiment. While the company has faced challenges in recent years, it has managed to maintain a strong presence in the global banking industry. As the global economy continues to evolve, investors should closely monitor the factors that could impact the future performance of HSBC and its stock price.

us stock market today live cha