Dow Jones US Total Stock Market Index Factsheet

author:US stockS -

Investors who are looking to diversify their portfolios often turn to the Dow Jones US Total Stock Market Index as a key benchmark. This index, also known as the Wilshire 5000 Total Market Index, provides a comprehensive view of the entire U.S. stock market. In this factsheet, we'll delve into the details of the Dow Jones US Total Stock Market Index, its history, composition, and how it can be a valuable tool for investors.

History and Background

The Dow Jones US Total Stock Market Index was launched in 1971 by Dow Jones Indices. It was created to provide a broader perspective on the U.S. stock market beyond just the 30 stocks that make up the Dow Jones Industrial Average. The index was initially developed in collaboration with Wilshire Associates.

Composition

The Dow Jones US Total Stock Market Index includes nearly 3,000 U.S. stocks across all sectors and market capitalizations. This makes it one of the most comprehensive stock market indexes in the world. The index is designed to be representative of the entire U.S. stock market, including small, mid-sized, and large companies.

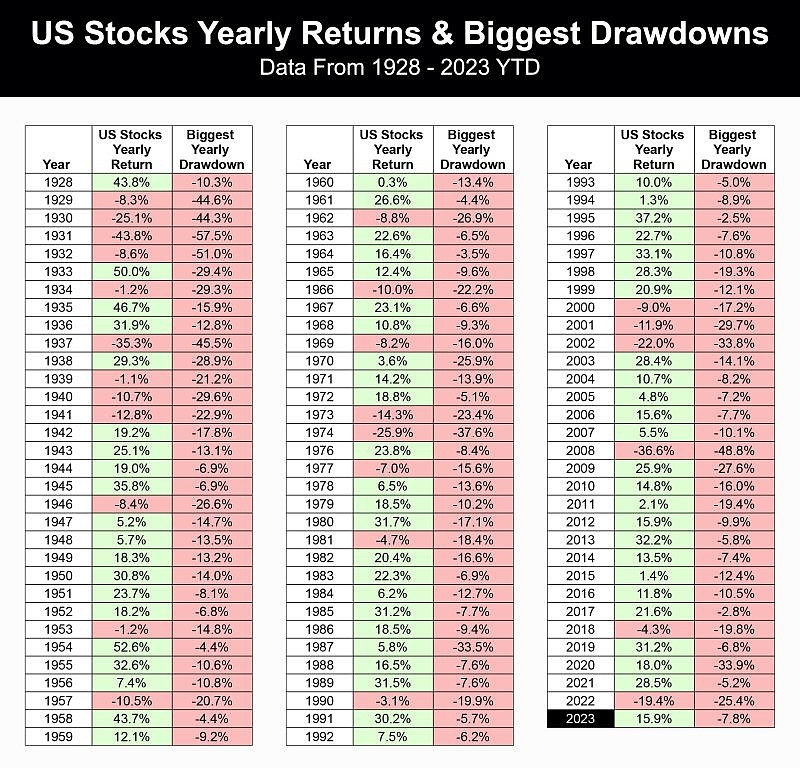

Performance

The performance of the Dow Jones US Total Stock Market Index has historically been closely aligned with the overall U.S. stock market. Over the long term, the index has provided a good indication of the health and direction of the U.S. economy.

Key Characteristics

Here are some key characteristics of the Dow Jones US Total Stock Market Index:

- Diversification: The index includes stocks from all sectors and market capitalizations, which can help reduce risk.

- Market Cap Weighting: The index is weighted by market capitalization, which means that larger companies have a greater impact on the index's performance.

- Inclusion Criteria: Companies must meet certain criteria to be included in the index, such as being publicly traded and having a minimum market capitalization.

Investment Opportunities

Investors can gain exposure to the Dow Jones US Total Stock Market Index through various investment vehicles, such as exchange-traded funds (ETFs) and mutual funds. One popular ETF that tracks the index is the iShares MSCI USA Index Fund (EFA).

Case Study: Performance During the Financial Crisis

During the financial crisis of 2008, the Dow Jones US Total Stock Market Index experienced significant volatility. However, over the long term, the index has recovered and continued to grow. This highlights the importance of long-term investing and the resilience of the U.S. stock market.

Conclusion

The Dow Jones US Total Stock Market Index is a valuable tool for investors looking to gain exposure to the entire U.S. stock market. Its comprehensive composition, diversification, and long-term performance make it a compelling benchmark for investors of all types. Whether you're a seasoned investor or just starting out, understanding the Dow Jones US Total Stock Market Index can help you make informed investment decisions.

us stock market today live cha