Current Stock Market Outlook US 2025

author:US stockS -

Introduction

The stock market is a dynamic and ever-evolving landscape, and predicting its future is a task that requires careful analysis and insight. As we approach 2025, many investors are eager to understand the current stock market outlook for the United States. In this article, we will delve into the key factors that could shape the stock market in the coming years, providing a comprehensive overview of what investors can expect.

Economic Growth and Interest Rates

One of the most critical factors influencing the stock market is economic growth. As the U.S. economy continues to recover from the COVID-19 pandemic, we can expect to see gradual but steady growth. This growth will likely be supported by low unemployment rates and strong consumer spending.

In terms of interest rates, the Federal Reserve has been gradually raising rates to combat inflation. However, the pace of these increases is expected to slow down in 2025, which could be beneficial for the stock market. Lower interest rates can lead to increased borrowing and investment, which can drive stock prices higher.

Sector Analysis

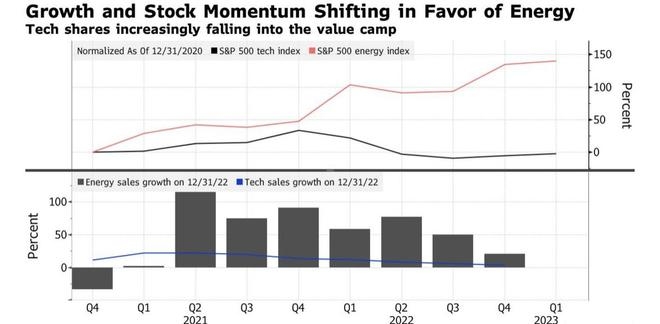

Several sectors are poised to perform well in the coming years. Technology remains a key driver of growth, with companies like Apple, Microsoft, and Google continuing to innovate and expand their market share. Healthcare is another sector that is expected to see significant growth, driven by an aging population and advancements in medical technology.

On the other hand, energy and financial services may face challenges. The shift towards renewable energy could impact traditional energy companies, while stricter regulations and increasing competition could pose challenges for financial institutions.

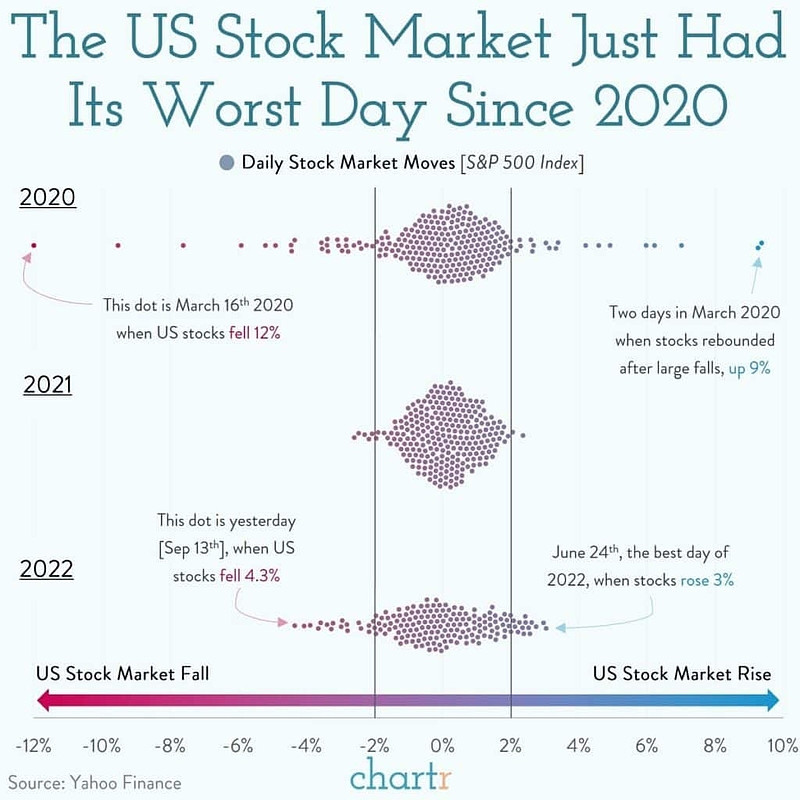

Market Volatility

Market volatility is an inevitable part of investing, and 2025 is unlikely to be an exception. Several factors could contribute to market volatility, including geopolitical tensions, political uncertainty, and global economic issues. Investors should be prepared for potential ups and downs and maintain a diversified portfolio to mitigate risk.

Case Study: Tesla

A prime example of how the stock market can react to significant news is the case of Tesla. In early 2021, Tesla announced that it would produce half a million vehicles by the end of the year, which sent its stock soaring. However, when the company missed its production target, the stock took a significant hit. This case highlights the importance of staying informed and adapting to market changes.

Conclusion

As we look towards 2025, the stock market outlook for the United States is cautiously optimistic. Economic growth, technological advancements, and a diversified portfolio can help investors navigate the potential challenges and opportunities that lie ahead. While predicting the future of the stock market is never an exact science, understanding the key factors at play can help investors make informed decisions.

us stock market today live cha