Can Indians Trade in the US Stock Market?

author:US stockS -

Are you an Indian investor looking to diversify your portfolio and tap into the vast opportunities of the US stock market? If so, you might be wondering, "Can Indians trade in the US stock market?" The answer is a resounding yes! However, there are certain regulations and steps you need to follow to ensure a smooth and legal trading experience. In this article, we will delve into the details of trading in the US stock market from India, including the necessary requirements, risks, and potential benefits.

Understanding the Basics

Firstly, it's important to understand that trading in the US stock market from India is subject to the rules and regulations set forth by the United States Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These regulations ensure that all investors, regardless of their nationality, trade in a fair and transparent manner.

Opening a Brokerage Account

The first step to trading in the US stock market is to open a brokerage account with a reputable firm. Several online brokers offer services that cater to international clients, including Indians. These brokers provide access to US stock exchanges like the New York Stock Exchange (NYSE) and the NASDAQ.

Requirements for Indian Investors

To open a brokerage account, Indian investors typically need to provide the following documents:

- Proof of Identity: Passport or government-issued ID.

- Proof of Residence: Recent utility bill or bank statement.

- Proof of Financial Stability: Bank statements or other financial documents to verify your financial standing.

- Bank Account Information: An international bank account to facilitate deposits and withdrawals.

Understanding Risks and Benefits

Risks:

- Currency Fluctuations: The Indian rupee and the US dollar can fluctuate significantly, impacting your returns.

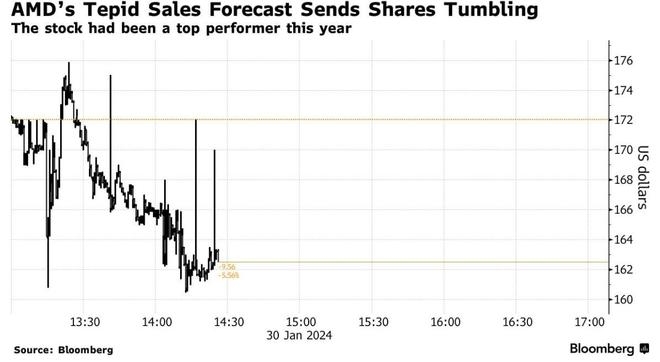

- Market Volatility: The US stock market is known for its volatility, which can lead to sudden gains or losses.

- Tax Implications: Profits from US stocks might be subject to capital gains tax in India.

Benefits:

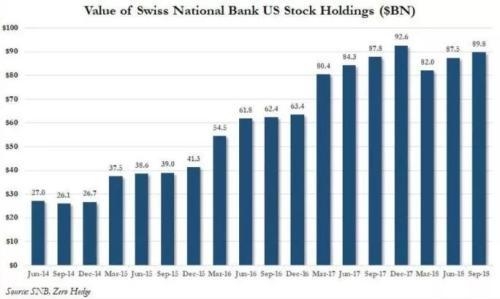

- Diversification: Investing in the US market can diversify your portfolio and mitigate risks associated with a single country's economy.

- Access to High-Growth Stocks: The US stock market is home to some of the world's largest and most innovative companies.

- Potential for High Returns: Over the long term, the US stock market has historically provided significant returns to investors.

Case Studies

Consider the example of Mr. Gupta, an Indian investor who opened a brokerage account with an online broker and invested in US tech stocks. Over the course of five years, his investment grew by 50%, despite the fluctuations in the Indian rupee and the US stock market. This highlights the potential for high returns and diversification through US stock market investments.

Conclusion

Trading in the US stock market from India is a feasible and attractive option for investors looking to diversify their portfolios. By understanding the necessary requirements, risks, and benefits, Indian investors can make informed decisions and potentially achieve significant returns. So, if you're ready to explore the opportunities of the US stock market, take the first step today and open your brokerage account!

us stock market today live cha