2025 US Stock Market: What Investors Should Expect

author:US stockS -

As we approach the year 2025, investors are keen to understand the potential trends and opportunities in the US stock market. The stock market has always been a rollercoaster ride, with ups and downs that can make or break portfolios. This article delves into what investors can expect in the US stock market in 2025, highlighting key sectors and strategies.

Technological Advancements and Innovation

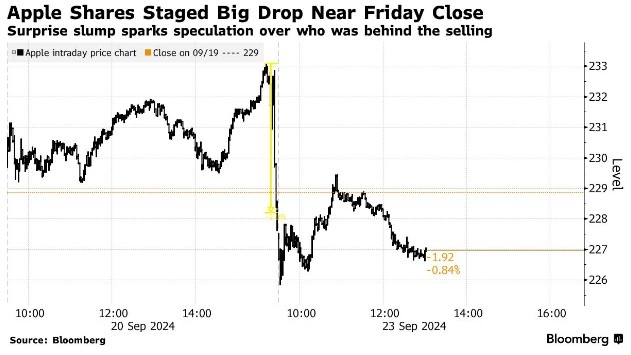

One of the most significant trends expected in the US stock market in 2025 is the continued growth of technology companies. With advancements in artificial intelligence, machine learning, and blockchain technology, these companies are poised to disrupt traditional industries. Tech giants like Apple, Google, and Amazon are likely to remain at the forefront, while startups in emerging sectors such as 5G and quantum computing may offer exciting investment opportunities.

Energy Sector Transformation

The energy sector is also expected to undergo a significant transformation in 2025. With the increasing focus on renewable energy and environmental sustainability, companies involved in solar power, wind energy, and electric vehicles are likely to see substantial growth. Tesla, a leader in electric vehicles, is expected to continue its upward trajectory, while SolarEdge and Enphase Energy may offer promising investments in the renewable energy space.

Healthcare Sector Innovations

The healthcare sector is another area where investors can expect significant growth in 2025. With advancements in biotechnology, telemedicine, and personalized medicine, companies in this sector are likely to benefit from increasing demand for innovative healthcare solutions. Biotech giants like Amgen and Gilead Sciences are expected to remain dominant, while pharmaceutical companies focusing on COVID-19 treatments and vaccines may offer short-term opportunities.

Emerging Markets and Globalization

The US stock market is not immune to global trends. In 2025, investors should keep an eye on emerging markets, which are expected to contribute significantly to global economic growth. Asia and Latin America are likely to be key regions, with companies like Tencent and Brazils Petrobras offering potential investment opportunities.

Dividend Stocks and Income Investing

For investors seeking stability and income, dividend stocks are likely to remain a popular choice in 2025. Companies with strong financials and consistent dividend payments, such as Johnson & Johnson and Procter & Gamble, are expected to provide steady returns.

Conclusion

As we look towards 2025, the US stock market presents a mix of opportunities and challenges. Investors should focus on sectors like technology, energy, and healthcare, while also considering global trends and dividend stocks. By staying informed and adapting to changing market conditions, investors can position themselves for success in the year ahead.

us stock market today live cha