Unlocking the Potential of US Large Value Company Stocks

author:US stockS -

In the ever-evolving world of investing, identifying the right stocks to add to your portfolio is crucial. One category that has consistently proven its worth is US large value company stocks. These stocks represent some of the most significant and stable companies in the United States, offering investors a blend of growth potential and stability. In this article, we'll explore the key aspects of these stocks, including their benefits, potential risks, and some notable examples.

Understanding US Large Value Company Stocks

Large value company stocks are shares of companies that are classified as "large-cap" and have a strong track record of profitability and stability. These companies typically have a market capitalization of over $10 billion and are known for their blue-chip status. Some of the most well-known large value companies include Apple, Microsoft, and Johnson & Johnson.

The Benefits of Investing in Large Value Company Stocks

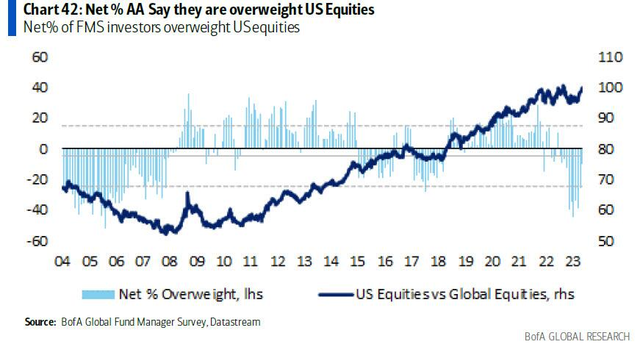

One of the primary benefits of investing in large value company stocks is their stability. These companies have a proven track record of success and are less likely to be affected by market volatility. This makes them a reliable investment option for investors looking to diversify their portfolios and reduce risk.

Another advantage of large value company stocks is their growth potential. While these companies are established and stable, they often have the resources and expertise to expand into new markets and products. This can lead to significant returns for investors over the long term.

Potential Risks to Consider

Despite their stability and growth potential, investing in large value company stocks is not without risks. One potential risk is that these companies may become less attractive to investors as they grow larger and more established. This can lead to a decrease in stock prices.

Additionally, large value companies may be more exposed to economic downturns compared to smaller companies. During a recession, these companies may face increased competition and decreased demand for their products or services.

Notable Examples of US Large Value Company Stocks

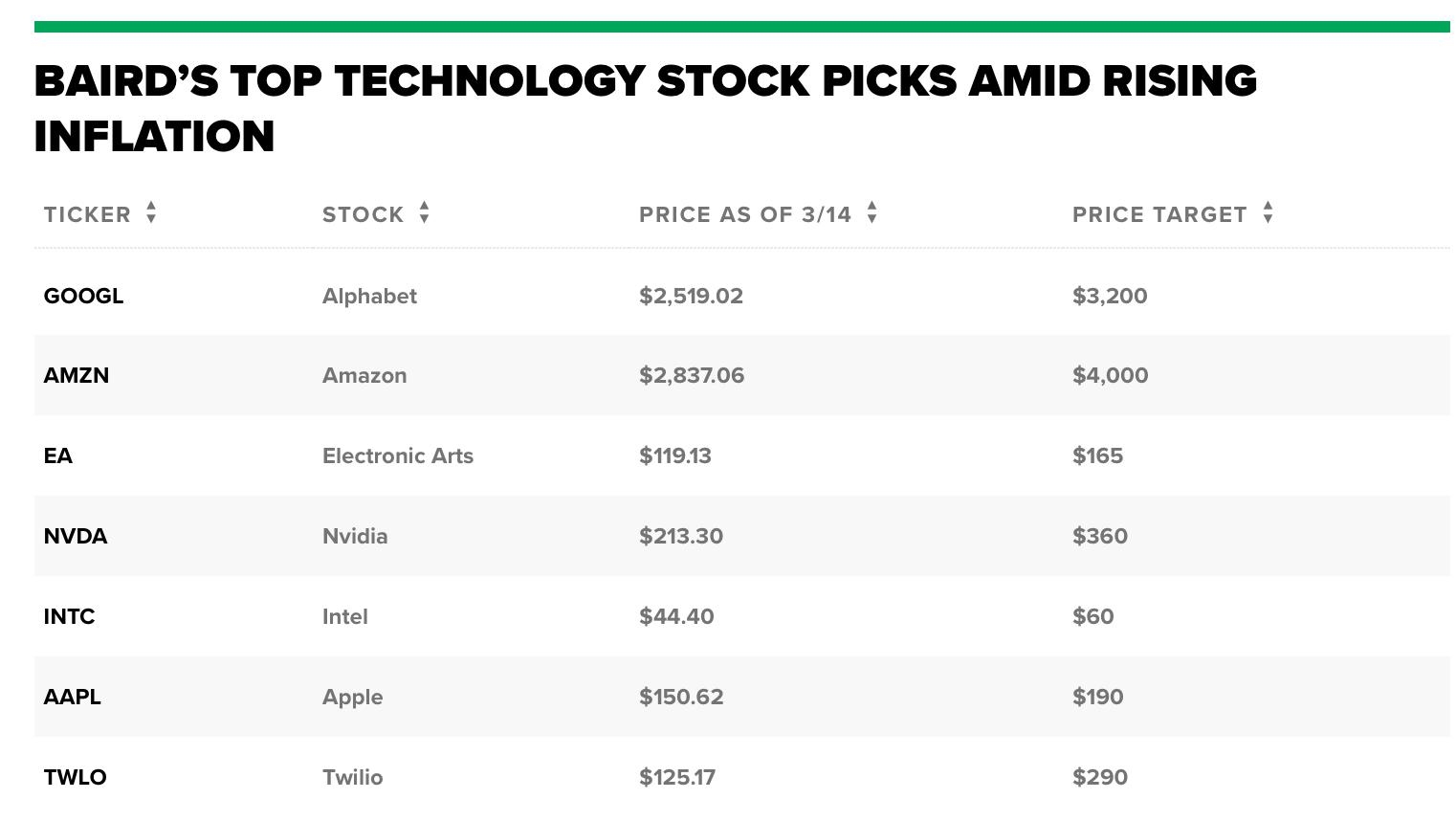

- Apple Inc. (AAPL): As one of the world's most valuable companies, Apple is a leader in the technology industry. Its products, including the iPhone, iPad, and Mac, have become household names, and the company continues to innovate and expand its product line.

- Microsoft Corporation (MSFT): Another tech giant, Microsoft, has a diverse portfolio of products and services, including Windows, Office, and Azure. The company has a strong position in the enterprise market and is well-positioned for future growth.

- Johnson & Johnson (JNJ): A leader in the healthcare industry, Johnson & Johnson offers a wide range of products and services, including pharmaceuticals, medical devices, and consumer healthcare products. The company has a long history of innovation and a strong focus on research and development.

Conclusion

Investing in US large value company stocks can be a smart move for investors looking to balance stability and growth. These companies offer a proven track record of success and the potential for long-term returns. However, it's important to carefully consider the risks and do thorough research before adding these stocks to your portfolio.

us stock market today