Understanding the US Stock Index Graph: A Comprehensive Guide

author:US stockS -

In the world of finance, the US stock index graph is a vital tool for investors and traders. It provides a snapshot of the overall performance of the stock market, allowing investors to make informed decisions. This article delves into the intricacies of the US stock index graph, explaining its significance, components, and how to interpret it effectively.

What is a US Stock Index?

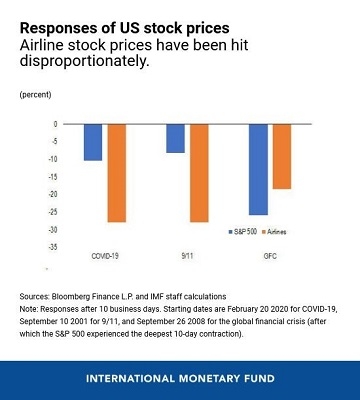

A stock index is a statistical measure of the value of a basket of stocks. It represents the performance of a particular sector or the entire stock market. The most well-known US stock index is the S&P 500, which tracks the performance of 500 large companies listed on stock exchanges in the United States.

Components of a US Stock Index Graph

A US stock index graph typically consists of the following components:

- Date Range: This indicates the time period over which the data is being analyzed.

- Index Value: This represents the current value of the index.

- Historical Data: This shows the past values of the index over time.

- Volatility: This measures the degree of variation in the index value over time.

Interpreting the US Stock Index Graph

To interpret the US stock index graph effectively, consider the following factors:

- Trends: Look for upward or downward trends in the graph. An upward trend indicates that the index is rising, while a downward trend suggests a decline.

- Volatility: High volatility can indicate uncertainty or significant market movements. Low volatility suggests a stable market.

- Support and Resistance Levels: These are price levels where the index has repeatedly struggled to move above or below. Understanding these levels can help predict future market movements.

Case Study: The S&P 500 Index

The S&P 500 index is a widely followed indicator of the US stock market. In 2020, the index experienced a significant drop due to the COVID-19 pandemic. However, it quickly recovered and reached new all-time highs in 2021. This case study demonstrates the importance of analyzing the US stock index graph to understand market trends and make informed investment decisions.

How to Use the US Stock Index Graph

To use the US stock index graph effectively, follow these steps:

- Identify the Time Frame: Determine the time frame you want to analyze, such as daily, weekly, or monthly.

- Analyze Trends: Look for patterns in the graph, such as upward or downward trends.

- Evaluate Volatility: Assess the degree of volatility in the index.

- Identify Support and Resistance Levels: Note the price levels where the index has struggled to move above or below.

- Make Informed Decisions: Use the information gathered to make informed investment decisions.

Conclusion

The US stock index graph is a powerful tool for investors and traders. By understanding its components and how to interpret it, you can gain valuable insights into the stock market and make informed investment decisions. Whether you are a seasoned investor or just starting out, familiarizing yourself with the US stock index graph is essential for success in the financial markets.

us stock market today