Understanding the US Market Stock Exchange: A Comprehensive Guide

author:US stockS -

In the heart of the global financial landscape, the United States Market Stock Exchange plays a pivotal role in shaping the economic world. As one of the largest and most influential stock exchanges, it is crucial to understand its dynamics and how it impacts investors and businesses alike. This article delves into the key aspects of the US Market Stock Exchange, including its history, major players, and strategies for success.

The Evolution of the US Market Stock Exchange

The US Market Stock Exchange has a rich history that dates back to the 18th century. It began with the establishment of the New York Stock Exchange (NYSE) in 1792, followed by the creation of other notable exchanges like the NASDAQ and the American Stock Exchange (AMEX). Over the years, these exchanges have evolved, adapting to the changing economic landscape and technological advancements.

Key Players in the US Market Stock Exchange

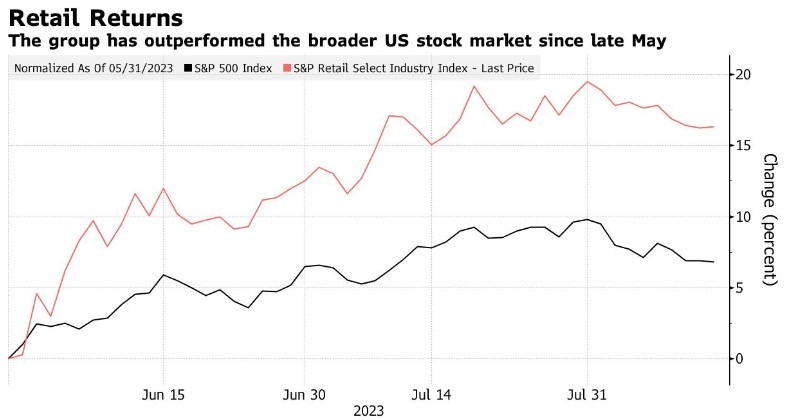

The US Market Stock Exchange is home to numerous influential players, including individual investors, institutional investors, corporations, and financial intermediaries. Each of these players plays a crucial role in the market's operation and growth.

Individual Investors: These are everyday people who invest their own money in the stock market. They often rely on research and financial advice to make informed decisions.

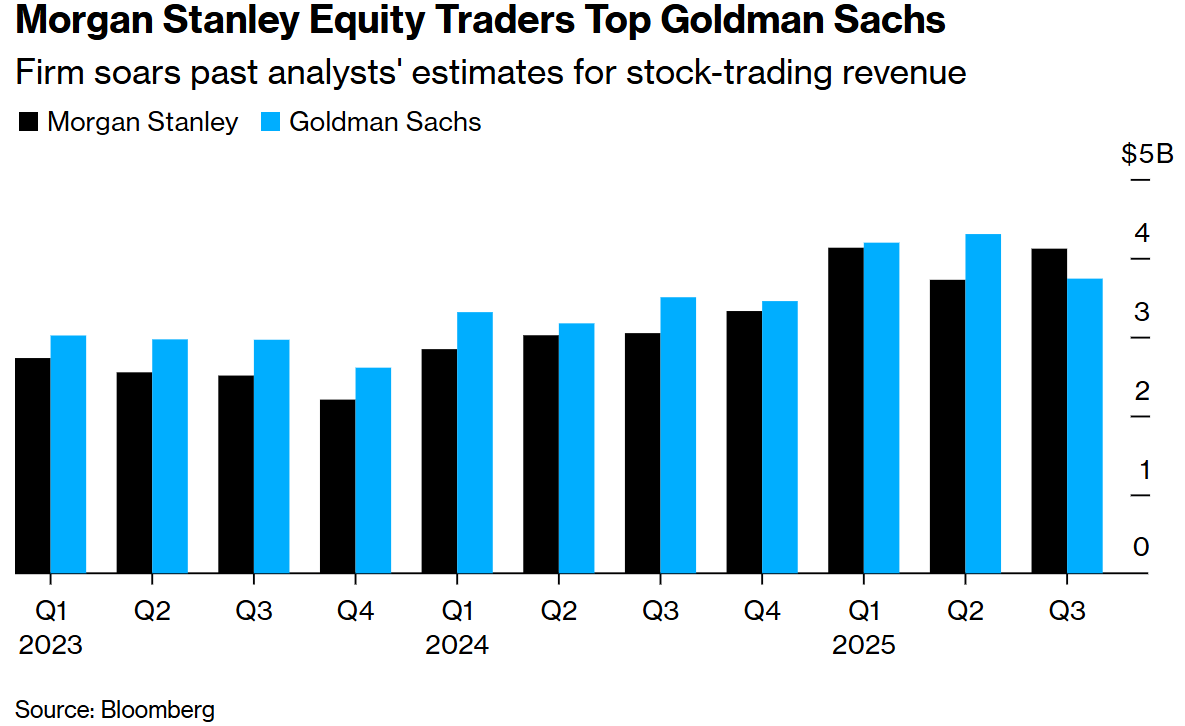

Institutional Investors: These are large organizations such as mutual funds, pension funds, and insurance companies. They have significant influence over the market and can drive significant price movements.

Corporations: Companies list their shares on the stock exchange to raise capital. They can also use the exchange to gain exposure and credibility in the market.

Financial Intermediaries: These are professionals like brokers and financial advisors who assist investors in buying and selling stocks.

Strategies for Success in the US Market Stock Exchange

To succeed in the US Market Stock Exchange, investors and corporations must adopt effective strategies:

For Individual Investors:

- Diversification: Diversify your portfolio to reduce risk.

- Research: Conduct thorough research before investing.

- Risk Management: Understand your risk tolerance and invest accordingly.

For Corporations:

- Transparency: Maintain transparency in financial reporting.

- Innovation: Innovate and adapt to changing market conditions.

- Strategic Partnerships: Form strategic partnerships to expand your market reach.

Case Studies

To illustrate the impact of the US Market Stock Exchange, let's consider a few case studies:

Apple Inc.: Apple, listed on the NASDAQ, has been a significant player in the US Market Stock Exchange. Its successful strategy of innovation and market expansion has led to its growth as a global leader in technology.

Tesla Inc.: Tesla, another NASDAQ-listed company, has revolutionized the automotive industry with its electric vehicles. Its listing on the exchange has provided it with access to capital for innovation and expansion.

Conclusion

The US Market Stock Exchange is a complex and dynamic entity that plays a crucial role in the global economy. By understanding its history, key players, and strategies for success, investors and corporations can navigate the market effectively. Whether you are an individual investor or a corporation, staying informed and adapting to the market's changes is essential for success.

us stock market today