Understanding the NASDAQ 100 Index: Real-Time Insights

author:US stockS -100(15)nasdaq(250)i(7)The(142)

In the ever-evolving world of financial markets, staying informed about key indices is crucial for investors and traders. The NASDAQ 100 Index is one such benchmark that has gained significant attention due to its representation of some of the most influential companies in the tech industry. This article delves into the NASDAQ 100 Index, focusing on its real-time data and insights that can help investors make informed decisions.

What is the NASDAQ 100 Index?

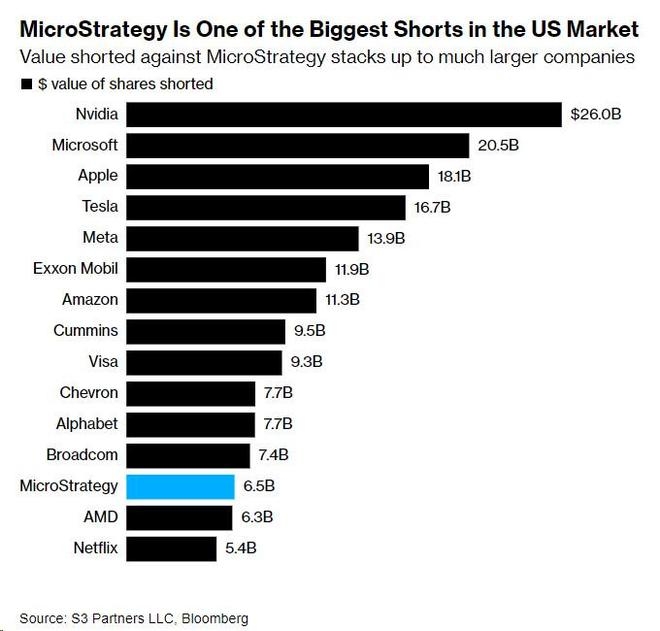

The NASDAQ 100 Index, often abbreviated as "NDX," tracks the performance of 100 of the largest non-financial companies listed on the NASDAQ Stock Market. This index includes a diverse range of sectors, but it is particularly known for its tech-heavy composition. Some of the most well-known companies in the index include Apple, Microsoft, Amazon, Google (Alphabet), and Facebook (Meta).

Real-Time Data: Why It Matters

Real-time data is essential for investors who want to stay ahead of market trends and make timely decisions. The NASDAQ 100 Index provides real-time updates, allowing investors to monitor the performance of the index and its constituent companies as the market moves. Here's why real-time data matters:

- Immediate Access to Market Trends: Real-time data enables investors to identify emerging trends and react quickly to market changes.

- Risk Management: By monitoring real-time data, investors can assess the risk associated with their investments and adjust their strategies accordingly.

- Opportunity Identification: Real-time updates can help investors identify opportunities to buy or sell stocks within the NASDAQ 100 Index.

Key Features of the NASDAQ 100 Index

The NASDAQ 100 Index offers several key features that make it a valuable tool for investors:

- Diversification: The index provides exposure to a wide range of sectors, including technology, retail, and healthcare.

- Market Capitalization: The index includes companies with a market capitalization of at least $10 billion, ensuring a focus on large, well-established companies.

- Innovation and Growth: The tech-heavy composition of the index reflects the innovation and growth potential of the companies it represents.

Case Study: Apple's Impact on the NASDAQ 100 Index

A prime example of how real-time data can influence market movements is the impact of Apple on the NASDAQ 100 Index. When Apple reports earnings or announces a new product, the stock's performance can significantly affect the index. For instance, during Apple's earnings report in October 2021, the company reported record revenue and earnings, sending its stock and the NASDAQ 100 Index higher.

How to Access Real-Time NASDAQ 100 Index Data

To stay informed about the NASDAQ 100 Index and its constituent companies, investors can access real-time data through various platforms:

- Financial News Websites: Websites like CNBC, Bloomberg, and Reuters provide real-time updates on the NASDAQ 100 Index and its constituent companies.

- Stock Market Data Providers: Platforms like Yahoo Finance, Google Finance, and Morningstar offer real-time data and analysis on the index.

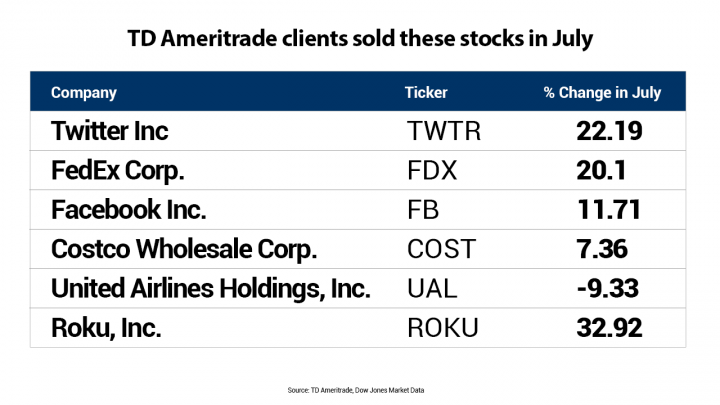

- Brokerage Platforms: Many online brokers, such as TD Ameritrade and E*TRADE, provide real-time data and trading tools for investors.

Conclusion

The NASDAQ 100 Index is a vital tool for investors looking to gain insights into the tech industry and the broader market. By understanding the index's composition, real-time data, and key features, investors can make informed decisions and capitalize on market trends. Whether you're a seasoned investor or just starting out, staying informed about the NASDAQ 100 Index is crucial for success in the financial markets.

us stock market today