Understanding US Premarket Stock Futures: A Comprehensive Guide

author:US stockS -

In the world of financial markets, staying ahead of the curve is crucial. For investors and traders, understanding the intricacies of the premarket stock futures is essential. These contracts are a key tool for predicting market movements and capitalizing on opportunities before the regular trading session begins. This article delves into the world of US premarket stock futures, explaining their significance, how they work, and providing insights for those looking to leverage this valuable trading resource.

What Are US Premarket Stock Futures?

US premarket stock futures are financial contracts that allow investors to speculate on the future price of a particular stock or index before the regular trading session opens. These futures are based on the underlying asset's price and are traded on various exchanges, such as the Chicago Mercantile Exchange (CME) and the New York Mercantile Exchange (NYMEX).

How Do They Work?

Premarket stock futures operate similarly to standard futures contracts. They are agreements between two parties to buy or sell an asset at a predetermined price and date in the future. In the case of premarket stock futures, the underlying asset is a stock or index, and the predetermined price and date are based on the expected market opening price.

Investors can trade these futures by taking a long or short position. A long position involves betting that the stock or index will rise, while a short position involves betting that it will fall. If the market opens higher than the premarket price, those with a long position will benefit, and vice versa for those with a short position.

Benefits of Trading US Premarket Stock Futures

Trading US premarket stock futures offers several advantages:

- Predict Market Movements: By analyzing premarket futures, investors can gain insights into market sentiment and predict potential movements in the stock or index.

- Access to Global Markets: Premarket futures allow investors to trade stocks from around the world, even when their local markets are closed.

- Hedge Risks: Investors can use premarket stock futures to hedge their portfolio against potential market downturns.

Key Factors Influencing Premarket Stock Futures

Several factors can influence the price of premarket stock futures:

- Economic Indicators: Data such as unemployment rates, GDP growth, and inflation can significantly impact market sentiment and, subsequently, premarket futures prices.

- Company News: Announcements, earnings reports, and other corporate news can lead to rapid price movements in premarket futures.

- Global Events: Political events, natural disasters, and other global events can have a profound impact on market sentiment and, by extension, premarket futures.

Case Study: The Impact of Premarket Stock Futures on the S&P 500

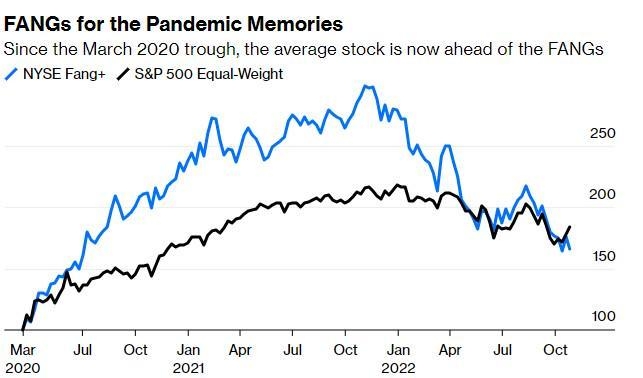

A prime example of the influence of premarket stock futures on the market is the S&P 500. In February 2020, as the COVID-19 pandemic began to unfold, premarket futures for the S&P 500 plummeted, signaling potential market turmoil. This anticipation of a downturn led to a massive sell-off in the days that followed, highlighting the importance of monitoring premarket futures for potential market shifts.

Conclusion

Understanding US premarket stock futures is crucial for investors and traders looking to gain an edge in the financial markets. By analyzing these contracts, investors can predict market movements, access global markets, and hedge risks. By staying informed and utilizing premarket stock futures effectively, investors can navigate the complex world of financial markets with greater confidence and success.

us stock market today