US Stocks in Canadian TFSA: A Smart Investment Strategy

author:US stockS -

In today's globalized financial market, investors are constantly seeking opportunities to diversify their portfolios. One such strategy involves investing in U.S. stocks within a Canadian Tax-Free Savings Account (TFSA). This approach offers a unique blend of potential growth and tax advantages. In this article, we'll explore the benefits and considerations of investing in U.S. stocks within a Canadian TFSA.

Understanding the Canadian TFSA

First, let's clarify what a TFSA is. A TFSA is a registered account available to Canadian residents, allowing them to save money tax-free throughout their lifetime. Contributions are not tax-deductible, but withdrawals are not taxed either. This makes it an excellent vehicle for long-term savings and investments.

Investing in U.S. Stocks

Investing in U.S. stocks within a TFSA can be a smart move for several reasons. The U.S. stock market is one of the largest and most diverse in the world, offering a wide range of investment opportunities. Here are some key benefits:

1. Diversification

By investing in U.S. stocks, you can diversify your portfolio geographically. This helps to reduce the risk associated with investing solely in Canadian stocks.

2. Access to Large Cap Stocks

The U.S. stock market is home to many large-cap companies, including household names like Apple, Microsoft, and Amazon. Investing in these companies can provide stable returns and growth potential.

3. Currency Fluctuations

Investing in U.S. stocks can also help you benefit from currency fluctuations. If the Canadian dollar strengthens against the U.S. dollar, your investments will be worth more when converted back to CAD.

How to Invest in U.S. Stocks within a Canadian TFSA

To invest in U.S. stocks within a Canadian TFSA, you'll need to follow these steps:

Open a TFSA: If you haven't already, open a TFSA and contribute to it. The annual contribution limit is adjusted each year and can be found on the Canada Revenue Agency website.

Choose a Broker: Select a brokerage firm that offers access to U.S. stocks. Some popular options include TD Ameritrade, E*TRADE, and Questrade.

Transfer Funds: Transfer funds from your TFSA to your brokerage account. Ensure that the funds are available in your trading account before proceeding.

Buy U.S. Stocks: Once the funds are in your brokerage account, you can start buying U.S. stocks. Be sure to research and understand the companies you're investing in.

Considerations and Risks

While investing in U.S. stocks within a Canadian TFSA offers many benefits, it's essential to consider the following risks:

- Currency Risk: Fluctuations in exchange rates can impact the value of your investments when converted back to CAD.

- Market Risk: U.S. stocks are subject to the same market volatility as any other investment.

- Transaction Costs: Be aware of any fees associated with buying and selling U.S. stocks, as well as currency conversion fees.

Case Study: Investing in U.S. Tech Stocks

Let's consider a hypothetical example. Imagine you decide to invest $10,000 in a TFSA, using it to buy shares of Apple and Microsoft. Over the next five years, these stocks appreciate in value, and you decide to sell them. Assuming the Canadian dollar remains relatively stable against the U.S. dollar, you could withdraw the funds from your TFSA, convert them back to CAD, and benefit from the tax-free growth.

Conclusion

Investing in U.S. stocks within a Canadian TFSA can be a powerful strategy for long-term growth and tax efficiency. By diversifying your portfolio, accessing large-cap companies, and potentially benefiting from currency fluctuations, you can create a robust investment strategy. However, it's essential to carefully research and understand the risks involved before making any investment decisions.

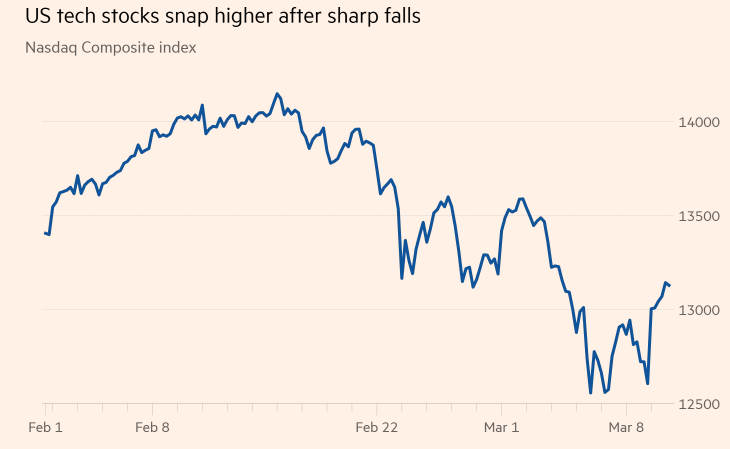

us stock market today