US Stock Markets 1 Year Chart: A Comprehensive Analysis

author:US stockS -

In today's fast-paced financial world, keeping an eye on the US stock markets is crucial for investors and traders. One of the best ways to gauge the market's performance is by examining its 1-year chart. This article provides a detailed analysis of the US stock markets over the past year, highlighting key trends and insights.

Understanding the 1-Year Chart

A 1-year chart is a visual representation of a stock market's performance over a 12-month period. It showcases the opening, closing, and average prices of stocks, as well as any major price movements or volatility. By analyzing this chart, investors can gain valuable insights into the market's health and potential future direction.

Key Aspects of the 1-Year Chart

- Stock Price Movement: This is the most straightforward aspect of the chart. It shows whether the stock price has increased, decreased, or remained stable over the past year.

- Volatility: This refers to the degree of price fluctuation. Higher volatility indicates a more unpredictable market, which can be both a risk and an opportunity.

- Support and Resistance Levels: These are critical price levels where the stock has repeatedly faced buying or selling pressure. Understanding these levels can help investors make informed decisions.

- Trends: Identifying trends—whether it's an upward, downward, or sideways trend—can guide investors in choosing the right investment strategies.

Analysis of the US Stock Markets

Over the past year, the US stock markets have displayed a mix of positive and negative trends. Let's take a closer look at some of the key developments.

Bullish Trends

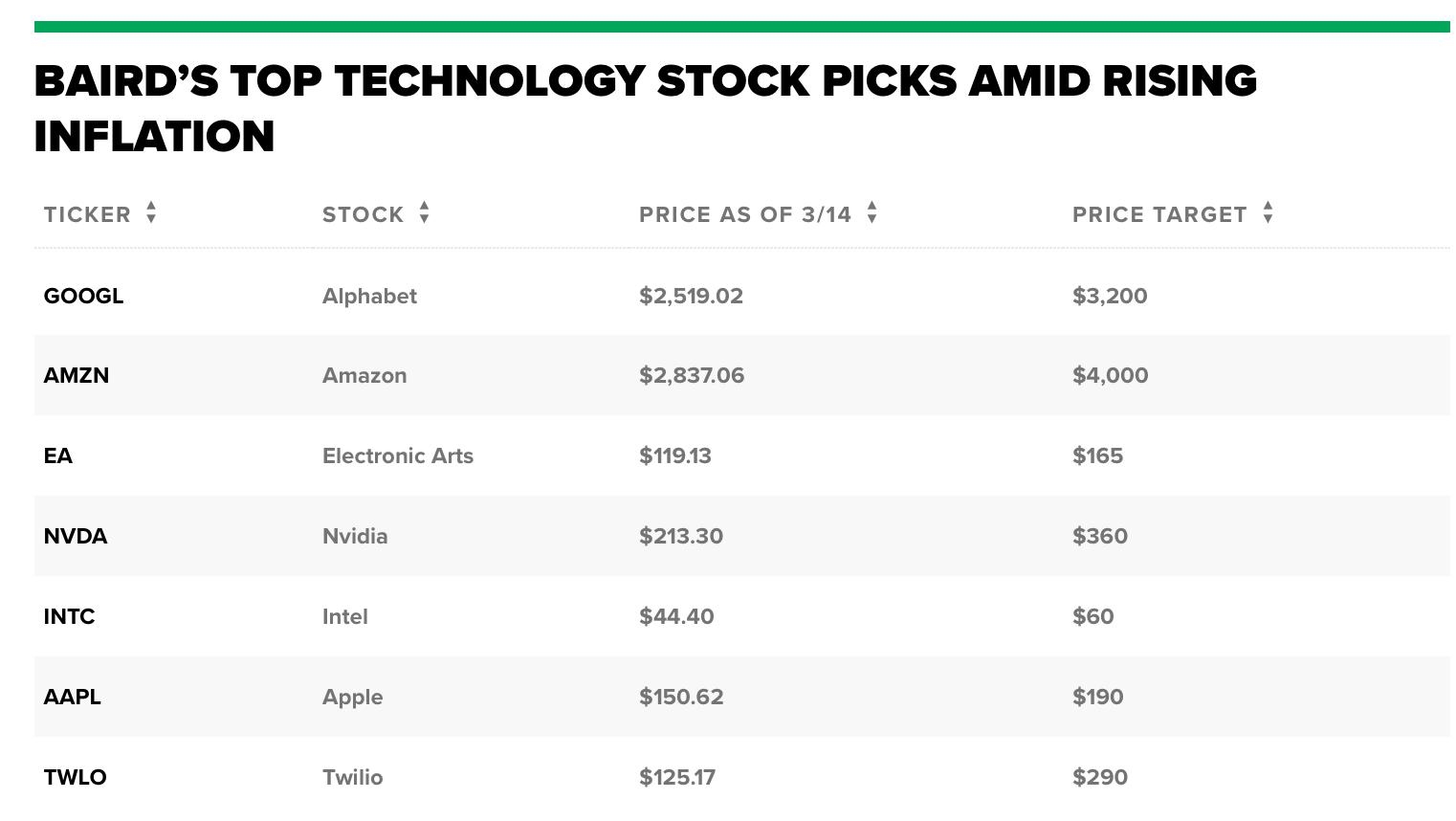

- Tech Stocks: The technology sector has been a major driver of the US stock market's growth over the past year. Companies like Apple, Amazon, and Microsoft have seen significant gains, contributing to the overall market's upward trend.

- Healthcare Stocks: The healthcare sector has also performed well, with companies like Johnson & Johnson and Pfizer benefiting from increased demand for medical products and services.

Bearish Trends

- Energy Stocks: The energy sector has faced challenges due to low oil prices and reduced demand for fossil fuels. Companies like ExxonMobil and Chevron have seen their stock prices decline.

- Retail Stocks: The retail sector has been hit hard by the rise of e-commerce and increased competition. Companies like Walmart and Target have seen their stock prices drop.

Case Studies

To further illustrate the trends in the US stock markets, let's take a look at two case studies:

- Apple Inc.: Over the past year, Apple's stock price has increased significantly, driven by strong sales of its iPhones and other products. The company's impressive earnings reports and robust growth prospects have contributed to this upward trend.

- Walmart Inc.: On the other hand, Walmart's stock price has decreased over the past year, as the company struggles to adapt to the changing retail landscape. Despite efforts to improve its online presence and expand its e-commerce capabilities, Walmart's stock has yet to recover.

Conclusion

The US stock markets have experienced a range of trends over the past year, with some sectors performing better than others. By analyzing the 1-year chart, investors can gain valuable insights into the market's performance and potential future direction. As always, it's important to stay informed and make informed decisions when investing in the stock market.

us stock market today