US Stock Market 2008 Crash Chart: A Detailed Analysis

author:US stockS -

The 2008 financial crisis was a pivotal moment in the history of the United States stock market. This article delves into the details of the crash, using the US Stock Market 2008 crash chart as a visual guide. We'll explore the factors that led to the crash, its immediate impact, and the long-term effects it had on the market.

The Lead-Up to the Crash

The years leading up to the 2008 crash were marked by a period of excessive risk-taking and speculative investment. Banks and financial institutions were aggressively packaging and selling mortgage-backed securities, many of which were tied to subprime loans. This created a false sense of security and led to an overvaluation of assets.

The Crash: A Visual Insight

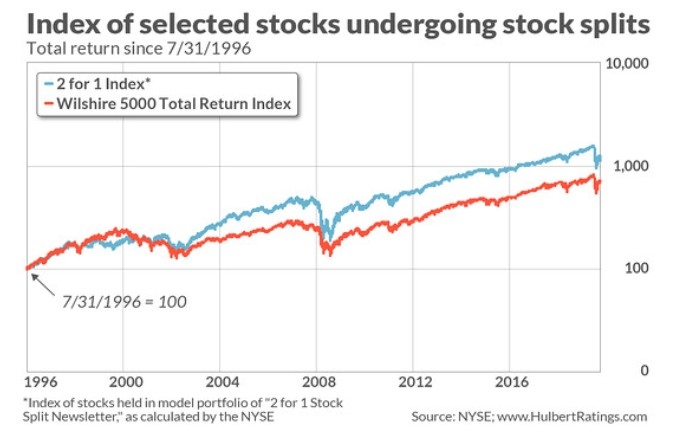

The US Stock Market 2008 crash chart illustrates the dramatic decline in stock prices. From the peak in October 2007 to the bottom in March 2009, the S&P 500 index fell by nearly 57%. This was one of the most significant market crashes in history, and it had far-reaching consequences.

[Image: US Stock Market 2008 Crash Chart]

As the chart shows, the crash began with the collapse of Lehman Brothers in September 2008. This event triggered a global financial panic, as investors lost confidence in the stability of the financial system. The subsequent weeks saw a rapid and steep decline in stock prices.

Immediate Impact

The immediate impact of the crash was devastating. Many investors saw their retirement savings vanish overnight. The stock market's decline also had a ripple effect on the broader economy, leading to a recession and high unemployment rates.

Long-Term Effects

Despite the initial shock, the US stock market has since recovered and reached new highs. The long-term effects of the 2008 crash, however, have been more complex. One of the most significant changes was the increased regulatory oversight of the financial industry. The Dodd-Frank Wall Street Reform and Consumer Protection Act was enacted in 2010 to prevent a similar crisis from occurring again.

Case Study: General Motors

One notable case study of the 2008 crash is General Motors (GM). Before the crash, GM was one of the largest and most successful automakers in the world. However, the financial crisis forced the company into bankruptcy. After emerging from bankruptcy, GM had to restructure its operations and focus on more fuel-efficient vehicles. This turnaround led to a significant recovery in the company's stock price.

Conclusion

The 2008 financial crisis and the subsequent stock market crash were a wake-up call for the financial industry. The US Stock Market 2008 crash chart serves as a reminder of the potential risks associated with speculative investment and excessive leverage. While the market has since recovered, the long-term effects of the crash continue to shape the financial landscape today.

us stock market today