US Stock Index Comparison: A Comprehensive Guide

author:US stockS -

Understanding the US Stock Market

The United States stock market is one of the largest and most influential in the world. It's home to several major stock indices that provide investors with a snapshot of the overall market's performance. In this article, we'll compare some of the most notable US stock indices and discuss their unique characteristics.

The S&P 500 (Standard & Poor's 500) Index

The S&P 500 is one of the most widely followed indices in the US. It consists of 500 large-cap companies from various industries, and it represents about 80% of the total market capitalization of the US stock market. This index is often used as a benchmark for the US stock market's overall performance.

Dow Jones Industrial Average (DJIA)

The DJIA is another well-known index, but it's different from the S&P 500. It consists of 30 large-cap companies that are listed on the New York Stock Exchange (NYSE) and the NASDAQ. The DJIA is known for its historical significance and is often seen as a gauge of the overall health of the US economy.

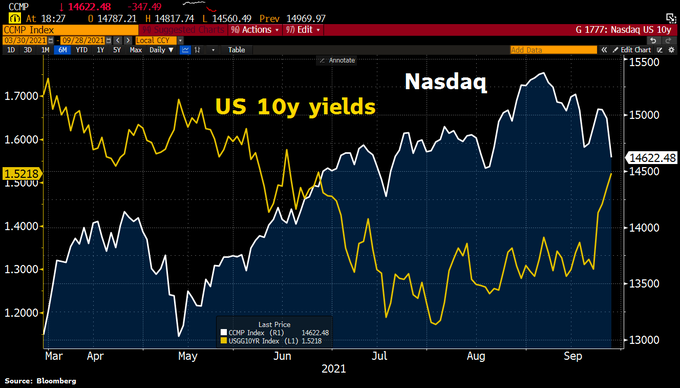

The NASDAQ Composite Index

The NASDAQ Composite Index is a broader index that includes all companies listed on the NASDAQ stock exchange. It covers a wide range of industries, including technology, healthcare, and biotechnology. The NASDAQ is particularly known for its role in the technology sector and is often seen as a leading indicator of innovation.

Differences and Similarities

While these indices have some similarities, they also have distinct differences:

- Market Cap: The S&P 500 and DJIA focus on large-cap companies, while the NASDAQ includes a mix of large, mid-cap, and small-cap companies.

- Industry Focus: The S&P 500 is diversified across various industries, but the DJIA is more concentrated in the industrial sector. The NASDAQ, on the other hand, is heavily weighted towards technology and healthcare.

- Performance: The S&P 500 and DJIA tend to be more stable than the NASDAQ, which can be more volatile due to its focus on emerging industries.

Case Studies

Let's take a look at some recent examples to understand how these indices have performed:

- In 2020, the S&P 500 and DJIA experienced a significant drop due to the COVID-19 pandemic. However, they quickly recovered and reached new highs by the end of the year.

- The NASDAQ, which is more sensitive to market changes, saw a more pronounced decline during the pandemic but also recovered faster than the other indices.

Conclusion

Understanding the differences between US stock indices is crucial for investors looking to make informed decisions. By analyzing the S&P 500, DJIA, and NASDAQ, investors can gain valuable insights into the overall health of the US stock market and identify potential opportunities and risks.

Keywords: US stock index comparison, S&P 500, Dow Jones Industrial Average, NASDAQ Composite Index, market cap, industry focus, performance, investment, market analysis

us stock market today