US Shutdown Stock: Navigating the Market Amidst Government Shutdowns

author:US stockS -

In the unpredictable world of stock markets, the term "US shutdown stock" has gained prominence as investors seek refuge in sectors that typically perform well during government shutdowns. This article delves into the impact of government shutdowns on the stock market, identifies sectors that historically benefit, and offers insights for investors looking to capitalize on this unique situation.

Understanding the US Shutdown

A government shutdown occurs when the federal government is unable to fund its operations due to a lack of authorized funding. This can happen when Congress fails to pass a budget or when the president vetoes a spending bill. Shutdowns can last from a few days to several weeks, depending on the situation.

Impact on the Stock Market

Government shutdowns can have a significant impact on the stock market. Typically, these events lead to uncertainty and volatility. However, certain sectors tend to perform better during shutdowns due to their resilience and the nature of their operations.

Sectors That Benefit from Shutdowns

Technology Stocks: Companies in the technology sector often thrive during shutdowns as they are less dependent on government contracts. Apple, Microsoft, and Amazon are examples of tech giants that tend to weather shutdowns relatively well.

Healthcare Stocks: The healthcare sector is another area that often benefits during shutdowns. Companies in this sector, such as Johnson & Johnson and Merck, continue to generate revenue as essential services like hospitals and pharmaceuticals remain operational.

Consumer Goods: Consumer goods companies, including Procter & Gamble and Coca-Cola, tend to perform well during shutdowns as people continue to buy everyday items regardless of government operations.

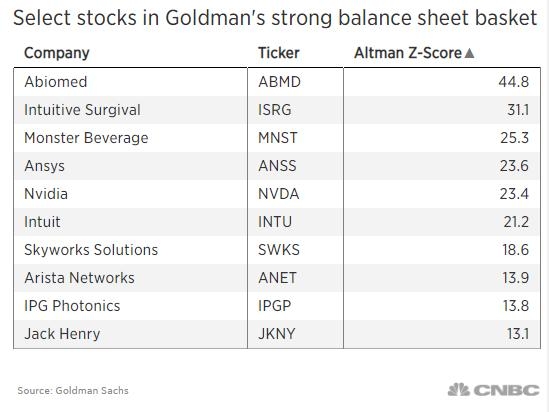

Financial Stocks: Financial institutions, such as Goldman Sachs and JPMorgan Chase, often see increased trading activity during shutdowns, leading to higher revenue for these companies.

Case Studies

During the 2018 government shutdown, technology stocks like Apple and Microsoft saw a modest increase in their stock prices, indicating their resilience during such events.

Similarly, during the 2019 shutdown, healthcare companies like Johnson & Johnson and Merck continued to report strong financial results, highlighting the sector's stability.

Investment Strategies

For investors looking to capitalize on the "US shutdown stock" trend, here are some strategies to consider:

Diversify Your Portfolio: Diversifying your portfolio with stocks from sectors that tend to perform well during shutdowns can help mitigate risks.

Monitor Market Trends: Stay informed about government shutdowns and their potential impact on the stock market. This will allow you to make informed decisions about when to buy or sell stocks.

Consider Dividend Stocks: Investing in companies with strong dividend policies can provide a steady income during uncertain times.

In conclusion, while government shutdowns can create uncertainty in the stock market, certain sectors tend to perform well during these periods. By understanding these trends and implementing smart investment strategies, investors can navigate the market and potentially capitalize on the "US shutdown stock" phenomenon.

us stock market today