Title: Pre Market US Stock Movers: Insights and Analysis

author:US stockS -

In the fast-paced world of stock trading, staying ahead of the curve is crucial for investors looking to maximize their returns. One of the most critical times to monitor market movements is during the pre-market hours. This period, often referred to as the "pre-market" or "pre-market trading," occurs before the official opening of the stock exchange. In this article, we will delve into the concept of pre-market US stock movers, providing insights and analysis to help you navigate this vital phase of the trading day.

Understanding Pre-Market US Stock Movers

Pre-market US stock movers refer to the stocks that are making significant price movements before the market opens. These movements can be upward or downward, indicating strong investor sentiment or news that could impact the stock's performance throughout the day. It is essential for investors to pay attention to these movers as they can set the tone for the entire trading session.

Why Monitor Pre-Market US Stock Movers?

Monitoring pre-market US stock movers offers several advantages:

- Identify Early Trends: By keeping an eye on pre-market movements, investors can identify early trends that may persist throughout the day. This can help them make informed decisions before the market opens.

- Get Ahead of the Curve: Investors who pay attention to pre-market stock movers can often get ahead of the market and capitalize on potential opportunities.

- Risk Management: Being aware of pre-market movements allows investors to adjust their portfolios accordingly, minimizing potential losses.

Key Factors Influencing Pre-Market US Stock Movers

Several factors can influence pre-market US stock movers:

- Economic News: Economic indicators, such as GDP growth, unemployment rates, and inflation data, can significantly impact stock prices.

- Company News: Company earnings reports, product launches, and management changes can lead to pre-market stock movements.

- Market Sentiment: Investor sentiment can drive pre-market movements, particularly in response to geopolitical events or significant news stories.

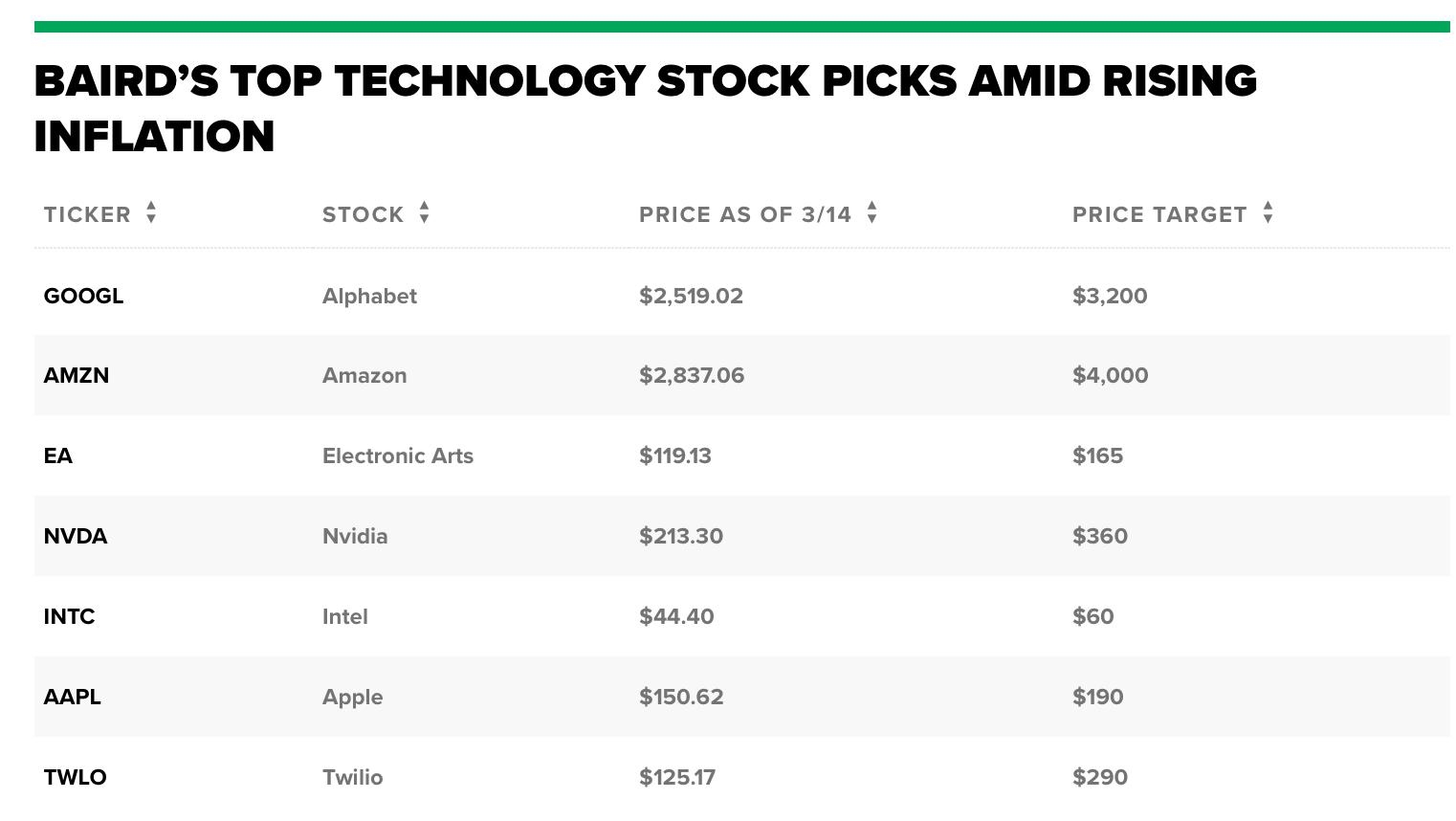

Case Study: Apple (AAPL)

Consider the case of Apple Inc. (AAPL), a leading technology company. In April 2021, Apple reported its quarterly earnings, which beat analyst expectations. As a result, the stock surged in pre-market trading, leading to a strong opening on the day of the earnings release. This example highlights how company news can significantly impact pre-market stock movements.

How to Find Pre-Market US Stock Movers

To find pre-market US stock movers, investors can use various tools and resources:

- Financial News Websites: Websites like CNBC, Bloomberg, and Reuters provide real-time updates on pre-market movements.

- Stock Market Apps: Many stock market apps offer pre-market trading features, allowing investors to stay informed on the go.

- Social Media: Following stock market influencers and analysts on social media platforms like Twitter can provide valuable insights into pre-market stock movements.

Conclusion

In conclusion, pre-market US stock movers are a vital component of the stock trading landscape. By understanding the factors influencing these movements and utilizing the right tools and resources, investors can gain a competitive edge in the market. Staying informed during pre-market hours can help investors make informed decisions, identify early trends, and manage risk effectively.

us stock market today