Title: Canada vs. US Stock Market: A Comprehensive Analysis

author:US stockS -

Introduction

When it comes to the global stock market, two of the most significant players are Canada and the United States. Both nations have well-established stock markets that offer a wide range of investment opportunities. However, investors often find themselves pondering the question: Which market offers better prospects? In this article, we will compare the Canadian and US stock markets, highlighting their key differences and similarities. By the end, you will have a clearer understanding of where to invest your hard-earned money.

Market Size and Liquidity

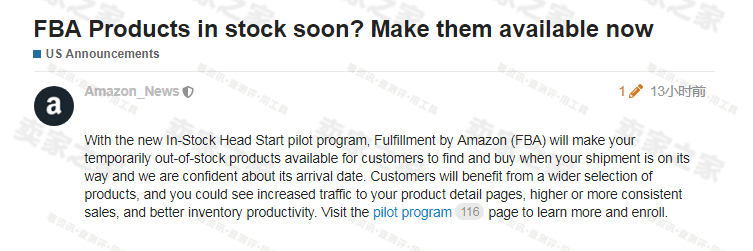

The first thing to consider when comparing the Canadian and US stock markets is their size and liquidity. The US stock market, with the New York Stock Exchange (NYSE) and the NASDAQ being the two largest exchanges, is by far the largest in the world. It has a market capitalization of over $35 trillion and offers a vast array of investment options, including shares of well-known companies like Apple, Microsoft, and Amazon.

On the other hand, the Canadian stock market, represented by the Toronto Stock Exchange (TSX) and the TSX Venture Exchange, has a market capitalization of around $1.9 trillion. While smaller than its American counterpart, the Canadian market still offers a diverse range of companies, including energy, mining, and technology stocks.

In terms of liquidity, the US market is more liquid, meaning it's easier to buy and sell stocks without affecting their price. However, the Canadian market is also relatively liquid, particularly for larger companies listed on the TSX.

Sector Composition

Another key difference between the Canadian and US stock markets lies in their sector composition. The US market is heavily dominated by technology, healthcare, and consumer discretionary sectors, reflecting the country's strong technological innovation and consumer culture.

In contrast, the Canadian market is more concentrated in the energy and materials sectors, particularly due to the country's abundant natural resources. This sectoral difference can significantly impact the performance of each market, depending on global commodity prices and economic conditions.

Regulatory Environment

The regulatory environment also plays a crucial role in shaping the Canadian and US stock markets. In the United States, the Securities and Exchange Commission (SEC) is responsible for overseeing the market and protecting investors. The SEC has stringent regulations that ensure market integrity and transparency.

In Canada, the responsibility lies with the Canadian Securities Administrators (CSA), which works to ensure fair and efficient markets and to protect investors. While the regulatory frameworks in both countries are robust, they differ in certain areas, such as reporting requirements and disclosure standards.

Historical Performance

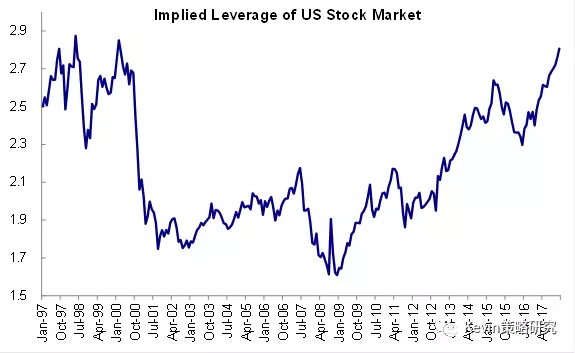

When it comes to historical performance, both the Canadian and US stock markets have experienced periods of strong growth. However, the US market has generally outperformed its Canadian counterpart over the long term. This is partly due to the larger market size and the presence of more multinational companies.

Conclusion

In conclusion, both the Canadian and US stock markets offer unique opportunities for investors. The US market is larger, more liquid, and dominated by technology and consumer sectors, while the Canadian market is smaller but offers exposure to natural resources and a more diverse range of companies. Investors should carefully consider their investment goals, risk tolerance, and market conditions when deciding where to allocate their capital.

us stock market today