Title: Big Short in US Stocks Need Watching

author:US stockS -

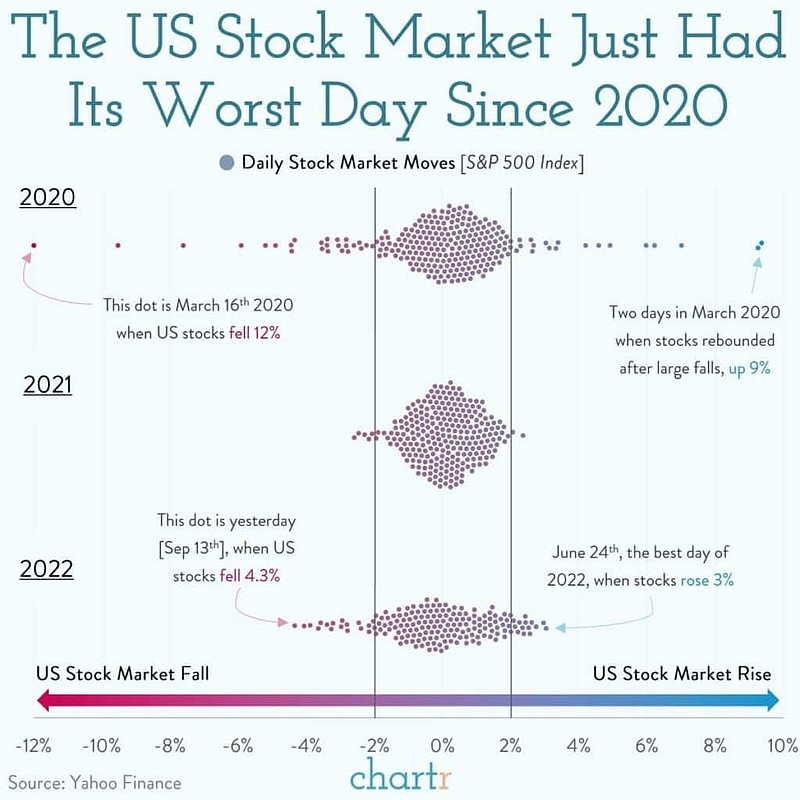

Introduction: In the volatile world of the stock market, the concept of a "big short" has become a term that investors and analysts alike are keeping a close eye on. A big short refers to a situation where a large number of investors bet on the decline of a particular stock or the overall market, potentially leading to significant market disruptions. This article delves into the implications of a big short in the US stock market and why it requires constant vigilance.

Understanding the Big Short: A big short occurs when a significant number of investors believe that the price of a stock or the overall market is overvalued and will eventually decline. These investors borrow shares from brokers and sell them at the current market price, with the intention of buying them back at a lower price in the future to return them to the broker and profit from the difference.

The Importance of Monitoring Big Shorts: Monitoring big shorts in the US stock market is crucial for several reasons:

Market Stability: A big short can lead to a rapid decline in stock prices, potentially causing panic selling and further market instability. By keeping an eye on big shorts, regulators and investors can take proactive measures to prevent excessive volatility.

Market Manipulation: Big shorts can be used as a tool for market manipulation, where investors collude to drive down the price of a stock for personal gain. Monitoring these activities helps in identifying and penalizing such manipulative practices.

Investor Sentiment: Big shorts can significantly impact investor sentiment, leading to a loss of confidence in the market. Understanding the reasons behind big shorts can help investors make informed decisions and maintain a balanced perspective.

Case Studies: Several high-profile cases highlight the potential risks associated with big shorts:

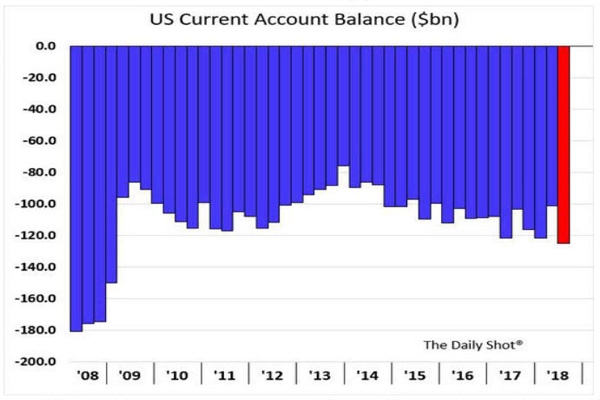

The 2008 Financial Crisis: The 2008 financial crisis was a prime example of a big short situation. Investors like Jim Chanos and John Paulson bet against financial institutions, predicting the impending collapse of the housing market. Their actions, along with the widespread belief in the market's overvaluation, contributed to the financial crisis.

Tesla's Big Short: In 2018, a group of short sellers targeted Tesla, betting against the company's stock. Their actions, combined with concerns about Tesla's financial health and production issues, led to a significant decline in the stock's price.

The Role of Regulators: Regulators play a vital role in monitoring big shorts and preventing market manipulation. They use various tools and methodologies to identify potential big short activities and take appropriate action:

Market Surveillance: Regulators monitor trading activities, looking for unusual patterns or suspicious behavior that may indicate a big short situation.

Short Selling Restrictions: In times of market volatility, regulators may impose short-selling restrictions to prevent excessive selling and stabilize the market.

Conclusion: A big short in the US stock market is a situation that requires constant monitoring and vigilance. Understanding the potential risks and implications of big shorts can help investors make informed decisions and contribute to market stability. By keeping an eye on these activities, regulators can ensure fair and transparent markets for all participants.

us stock market today