Tesla Stock Price on NASDAQ: A Comprehensive Analysis

author:US stockS -Tesla(9)nasdaq(250)Stock(238)Compr(11)Price(113)

In the ever-evolving world of technology and innovation, Tesla Inc. (NASDAQ: TSLA) has emerged as a leader in the electric vehicle (EV) industry. The company's stock has been a topic of intense interest, with investors closely monitoring its performance on the NASDAQ. This article delves into the factors influencing Tesla's stock price and provides a comprehensive analysis of its trajectory on the NASDAQ.

Historical Performance

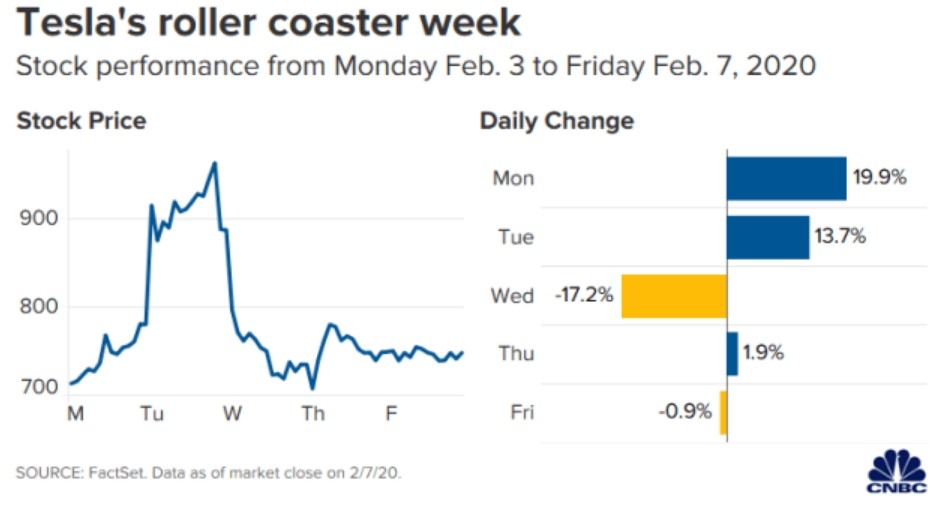

Tesla's stock has seen a rollercoaster ride since its initial public offering (IPO) in 2010. The company's stock price has experienced significant volatility, with periods of rapid growth and sudden drops. In the early years, the stock price struggled to gain traction, but it has since soared to new heights.

One of the key factors contributing to Tesla's stock surge has been its remarkable growth in revenue and market share. The company has expanded its product line to include not only electric cars but also solar energy products and battery storage solutions. This diversification has helped Tesla become a more resilient and attractive investment.

Market Sentiment and Analyst Ratings

Market sentiment plays a crucial role in the stock price of any company, and Tesla is no exception. Positive news, such as new product launches, partnerships, and regulatory approvals, tends to drive the stock price higher. Conversely, negative news, such as production delays or safety recalls, can lead to a decline in the stock price.

Analyst ratings also have a significant impact on Tesla's stock price. Many analysts have a bullish outlook on the company, assigning strong buy or outperform ratings. These positive ratings reinforce investor confidence and can lead to increased demand for Tesla's stock.

Technological Advancements and Innovation

Tesla's commitment to innovation and technological advancements has been a key driver of its stock price. The company has been at the forefront of developing autonomous driving technology, battery technology, and energy storage solutions. These advancements not only enhance Tesla's competitive position but also contribute to its long-term growth prospects.

Regulatory Environment and Electric Vehicle Industry Growth

The regulatory environment and the growth of the electric vehicle industry also play a significant role in Tesla's stock price. As governments around the world implement stricter emissions standards and promote the adoption of electric vehicles, Tesla stands to benefit. The company's leadership position in the EV market makes it a key player in this growing industry.

Case Studies

One notable case study is Tesla's partnership with Panasonic for battery production. This collaboration has helped Tesla reduce costs and improve battery production capacity, leading to increased profitability. Another example is Tesla's acquisition of SolarCity, which has expanded the company's presence in the renewable energy market.

Conclusion

In conclusion, Tesla's stock price on the NASDAQ has been influenced by a variety of factors, including market sentiment, technological advancements, and the growth of the electric vehicle industry. As Tesla continues to innovate and expand its product line, its stock price is likely to remain a key focus for investors. While the stock price may experience volatility, the long-term growth prospects of Tesla remain strong.

us stock market today