Stock Markets Plunge Due to US-Canada Trade Confusion

author:US stockS -

In recent days, the stock markets have witnessed a significant plunge, with many attributing it to the confusion surrounding the trade relationship between the United States and Canada. The uncertainty has sent shockwaves through the financial markets, leading to a surge in volatility and uncertainty. This article aims to delve into the factors contributing to this confusion and its impact on the stock markets.

The US-Canada Trade Relationship

The United States and Canada have a long-standing and robust trade relationship, which is the world's largest bilateral trade relationship. This trade relationship has been instrumental in driving economic growth and prosperity for both nations. However, recent developments have cast a shadow over this relationship, causing apprehension and concern among investors.

Trade Confusion and Its Impact

The confusion surrounding the US-Canada trade relationship has its roots in the recent imposition of tariffs by the United States on Canadian steel and aluminum. While the United States cited national security concerns as the reason for these tariffs, Canada and many other countries argue that such measures are protectionist in nature and go against international trade agreements.

The uncertainty caused by these tariffs has led to a decline in investor confidence. Many companies with significant operations in both the United States and Canada have been affected, with some announcing job cuts and reduced investments. This has created a ripple effect, leading to a widespread sell-off in the stock markets.

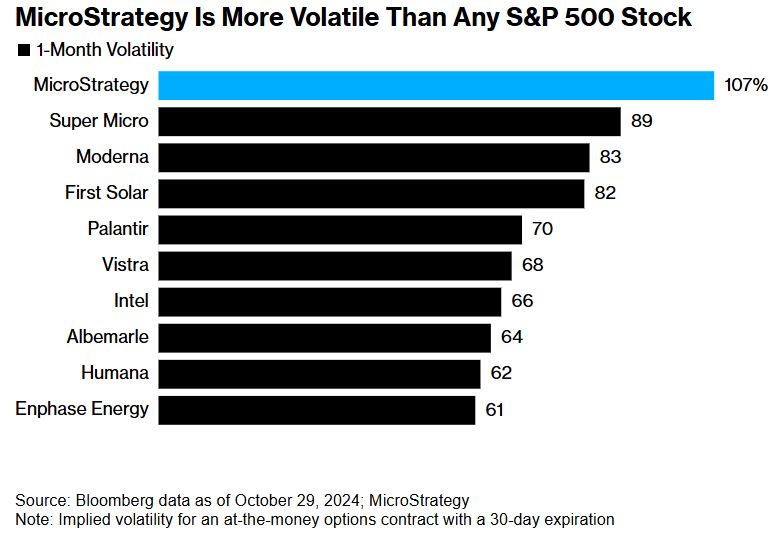

Market Volatility

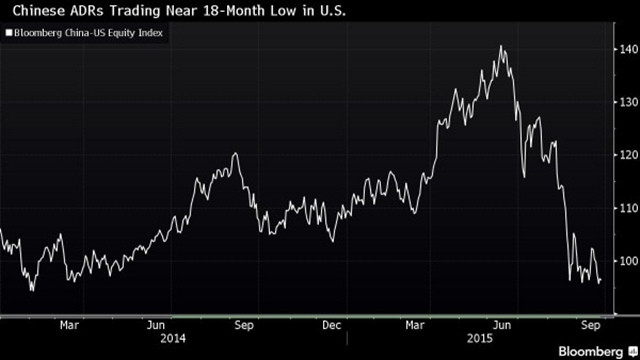

The stock markets have been experiencing heightened volatility as investors react to the trade uncertainty. The confusion has not only affected the markets in the United States and Canada but has also had a global impact. Many emerging markets and developed economies that are closely tied to the US-Canada trade relationship have seen their stock markets plummet.

Case Studies

To illustrate the impact of the trade confusion on the stock markets, let's consider two case studies.

General Motors (GM): GM has significant operations in both the United States and Canada. The imposition of tariffs by the United States has forced GM to raise the prices of its vehicles in the US market, leading to a decline in sales. This has affected the company's stock price, which has seen a significant decline over the past few months.

Walmart: Walmart, one of the largest retailers in the United States, sources many of its products from Canada. The imposition of tariffs has led to increased costs for Walmart, which has passed these costs onto consumers. This has led to a decrease in consumer spending and a decline in Walmart's stock price.

Conclusion

The confusion surrounding the US-Canada trade relationship has had a profound impact on the stock markets. The uncertainty has led to volatility and a widespread sell-off in the markets. As the situation continues to unfold, investors remain cautious and on edge, waiting for clarity on the future of the US-Canada trade relationship.

us stock market today