Small Cap US Stocks: Unveiling the Growth Potential

author:US stockS -

In the vast landscape of the United States stock market, small-cap stocks often fly under the radar. However, these companies, with market capitalizations ranging from

Understanding Small-Cap Stocks

Small-cap stocks are generally associated with higher risk compared to their larger counterparts. However, this risk often comes with the promise of higher returns. These companies are often in the early stages of growth, with the potential to expand rapidly. This growth potential is what attracts many investors to small-cap stocks.

Key Characteristics of Small-Cap Stocks

- Innovation and Growth: Small-cap companies are often at the forefront of innovation. They have the flexibility to experiment with new ideas and technologies, which can lead to significant growth.

- High Volatility: Due to their smaller size and market exposure, small-cap stocks tend to be more volatile. This volatility can lead to significant price swings, both in favor of and against the investor.

- Higher Risk: As mentioned earlier, small-cap stocks are generally riskier than large-cap stocks. This risk is due to factors such as limited financial resources, less established business models, and higher market competition.

Identifying Growth Potential

To identify the growth potential of small-cap stocks, investors should consider several factors:

- Financial Health: Analyze the company's financial statements, including revenue growth, profit margins, and debt levels.

- Management Team: Evaluate the experience and track record of the company's management team.

- Market Trends: Understand the industry trends and how the company fits into the larger market landscape.

- Product or Service Innovation: Look for companies that are developing innovative products or services that have the potential to disrupt the market.

Case Studies

Let's take a look at a couple of successful small-cap stocks:

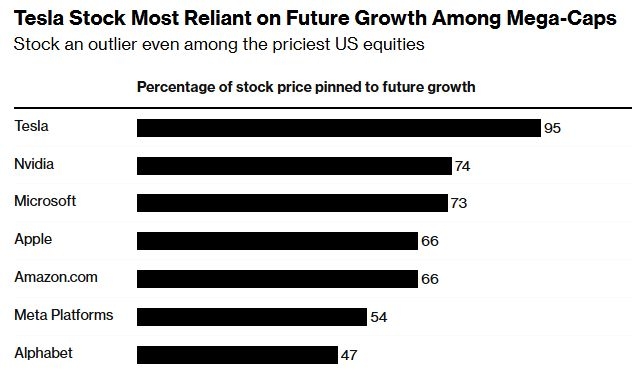

- Tesla, Inc. (TSLA): Once a small-cap stock, Tesla has grown exponentially, becoming one of the most valuable companies in the world. Its innovative electric vehicles and renewable energy products have revolutionized the automotive and energy sectors.

- Facebook, Inc. (FB): Before its initial public offering (IPO), Facebook was a small-cap stock. Its innovative social media platform has transformed the way people communicate and has generated significant revenue through targeted advertising.

Conclusion

Small-cap US stocks offer immense growth potential, but they come with higher risk. By conducting thorough research and analyzing various factors, investors can identify promising small-cap stocks and potentially achieve significant returns. Remember, the key to success in small-cap investing is patience and a long-term perspective.

us stock market today