SiriusXM US Stock Price: A Comprehensive Analysis

author:US stockS -

In the ever-evolving landscape of the entertainment industry, SiriusXM has emerged as a dominant player, captivating millions of listeners across the United States. With its robust lineup of music, sports, and talk programming, the company has not only secured its place in the market but has also become a significant investment opportunity. In this article, we delve into the current SiriusXM US stock price, its historical performance, and the factors that influence its market value.

Understanding SiriusXM's Stock Performance

The stock of SiriusXM, traded under the ticker symbol SIRI, has seen its fair share of ups and downs over the years. Understanding the current SiriusXM US stock price requires an examination of both its historical performance and the broader market conditions. As of the latest available data, the stock is trading at approximately $6.50 per share.

Historical Stock Performance

In the past decade, SiriusXM's stock has experienced significant volatility. For instance, in 2012, the stock reached an all-time high of

Factors Influencing Stock Price

Several factors contribute to the fluctuation of the SiriusXM US stock price. Here are some of the key factors to consider:

- Revenue Growth: SiriusXM's revenue has been on a steady upward trajectory, driven by its expanding subscriber base and the introduction of new products and services. A strong revenue growth rate can positively impact the stock price.

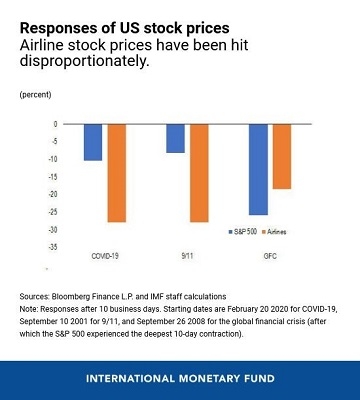

- Market Competition: The company faces stiff competition from traditional radio stations and streaming platforms like Spotify and Apple Music. Any negative developments in the competitive landscape can negatively impact the stock price.

- Regulatory Changes: The regulatory environment plays a crucial role in shaping the company's future. Changes in regulations, such as those related to satellite radio broadcasting, can have a significant impact on the stock price.

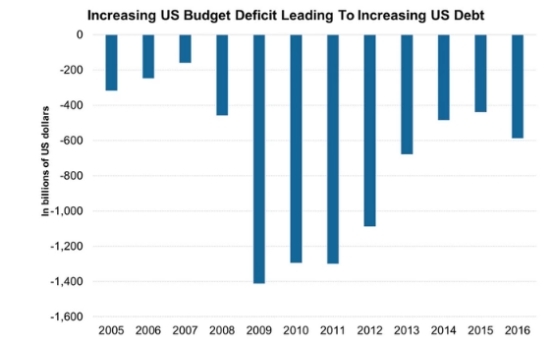

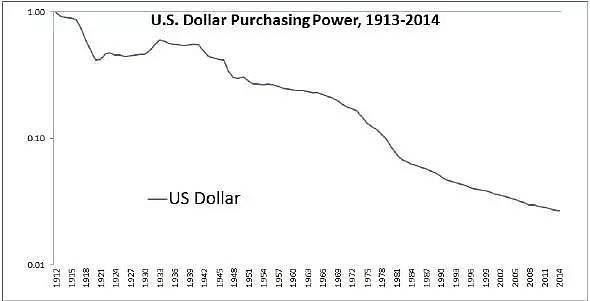

- Economic Conditions: The overall economic conditions, including interest rates and inflation, can influence the stock price. A strong economy typically leads to higher stock prices, while a weak economy can have the opposite effect.

Case Study: SiriusXM's Acquisition of Pandora

One notable event that impacted the SiriusXM US stock price was the company's acquisition of Pandora in 2019. The acquisition was aimed at expanding SiriusXM's digital presence and diversifying its revenue streams. While the acquisition was initially met with skepticism, it has since proven to be a strategic move, contributing to the company's growth and stability.

Conclusion

In conclusion, the SiriusXM US stock price is influenced by a variety of factors, including revenue growth, market competition, regulatory changes, and economic conditions. While the stock has experienced volatility in the past, its long-term prospects remain promising. As the company continues to innovate and expand its offerings, investors should keep a close eye on its stock performance.

us stock market today