September 5, 2025: US Stock Market Closing Summary

author:US stockS -

Market Recap: A Mixed Bag of Gains and Losses

On September 5, 2025, the US stock market closed with a mix of gains and losses, reflecting the ongoing volatility in the financial landscape. The S&P 500 and the Dow Jones Industrial Average experienced mixed results, while the NASDAQ Composite managed to post a slight gain. Here's a detailed summary of the day's trading activities.

S&P 500 and Dow Jones Industrial Average

The S&P 500, a widely followed benchmark index, closed slightly lower on the day. The index lost 0.3% of its value, bringing its year-to-date return to 9.2%. The downward trend was primarily driven by a decline in technology stocks, which accounted for more than half of the index's losses. Key sectors such as energy, financials, and real estate also contributed to the overall decline.

The Dow Jones Industrial Average, on the other hand, closed slightly higher, gaining 0.1% of its value. The index's performance was supported by a surge in consumer discretionary stocks, particularly in the retail and automotive sectors. However, the index was unable to sustain its upward momentum, as losses in other sectors, including technology and communication services, offset the gains.

NASDAQ Composite

The NASDAQ Composite, which tracks the performance of technology stocks, managed to post a slight gain of 0.2% on the day. The index's performance was driven by strong gains in the semiconductor and biotechnology sectors. Companies such as NVIDIA and Amgen contributed to the overall upward trend, offsetting losses in other technology stocks.

Sector Performance

The technology sector was the biggest loser on the day, with the S&P 500 Technology Sector Index down 1.2%. The decline was primarily driven by concerns about rising interest rates and inflation, which have been weighing on the sector for several months. Key players such as Apple, Microsoft, and Amazon experienced significant losses.

The energy sector, on the other hand, was the strongest performer, with the S&P 500 Energy Sector Index up 1.5%. The rise was attributed to a surge in oil prices, which were supported by supply concerns and geopolitical tensions in the Middle East.

Stock Market Analysis

The mixed performance of the US stock market on September 5, 2025, highlights the ongoing volatility in the financial landscape. The technology sector's decline was a reminder of the challenges faced by companies in the wake of rising interest rates and inflation. However, the energy sector's strong performance demonstrated the potential for growth in other sectors.

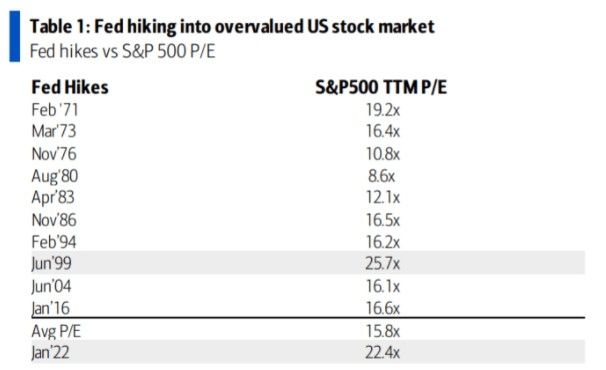

One key factor that influenced the market's performance was the Federal Reserve's decision to raise interest rates earlier in the week. The Fed's move to combat inflation has been a major concern for investors, as it could lead to higher borrowing costs and slower economic growth.

Case Study: NVIDIA

One notable case study from the day was NVIDIA, a leading player in the semiconductor industry. The company's stock experienced a significant decline, falling 3.2% on the day. The decline was attributed to concerns about the company's revenue growth and competition from other players in the market. Despite the decline, NVIDIA remains a strong performer in the technology sector, with a market capitalization of over $500 billion.

In conclusion, the US stock market closed with a mixed bag of gains and losses on September 5, 2025. The technology sector's decline was a reminder of the challenges faced by companies in the wake of rising interest rates and inflation. However, the energy sector's strong performance demonstrated the potential for growth in other sectors. As investors continue to navigate the volatile financial landscape, it's important to stay informed and make informed decisions.

us stock market today