Reason for Us Stock Market Crash Today

author:US stockS -

Introduction

The stock market is a reflection of the economic landscape, and as such, it often mirrors the ups and downs of the broader economy. Today, investors are on edge as the US stock market experiences a crash. In this article, we delve into the potential reasons behind this sudden downturn.

Economic Indicators

One of the primary reasons for the stock market crash today could be the release of economic indicators that show a slowing economy. For instance, the Federal Reserve's Beige Book, a summary of economic conditions in the United States, may have revealed signs of weakening consumer spending and business investment. Such data can lead to increased concerns about the economy's health, prompting investors to sell off stocks in a bid to protect their investments.

Corporate Profits

Another factor contributing to the stock market crash today might be the decline in corporate profits. Many companies have reported lower-than-expected earnings, which can lead to a negative outlook for the stock market. For instance, if a major tech company such as Apple or Google announces disappointing earnings, it can trigger a ripple effect across the entire market, causing widespread panic selling.

Geopolitical Tensions

Geopolitical tensions are also a significant concern for investors. Issues such as trade disputes, political instability, and conflict in key regions can cause uncertainty and volatility in the stock market. For example, if there is a sudden escalation in tensions between the United States and China, investors may become wary of investing in companies that rely heavily on trade with China, leading to a sell-off of their stocks.

Market Sentiment

Market sentiment plays a crucial role in the stock market's performance. When investors are optimistic, they tend to buy more stocks, driving up prices. Conversely, when investors are pessimistic, they sell off their stocks, leading to a crash. Today, negative sentiment may be fueling the stock market crash, with investors reacting to various negative news and economic indicators.

Case Study: The 2020 Stock Market Crash

To understand the potential impact of these factors, let's consider a case study: the 2020 stock market crash. This crash was triggered by a combination of factors, including the COVID-19 pandemic, economic uncertainty, and a surge in market volatility. As the pandemic began to spread, companies saw a significant decline in demand for their products and services, leading to lower earnings. Additionally, investors were reacting to the uncertainty surrounding the pandemic's impact on the economy, leading to widespread panic selling.

Conclusion

In conclusion, the stock market crash today could be attributed to a combination of economic indicators, corporate profits, geopolitical tensions, and market sentiment. While it's challenging to predict the future of the stock market, understanding these factors can help investors make more informed decisions. As always, it's important to keep a long-term perspective and avoid making impulsive decisions based on short-term market movements.

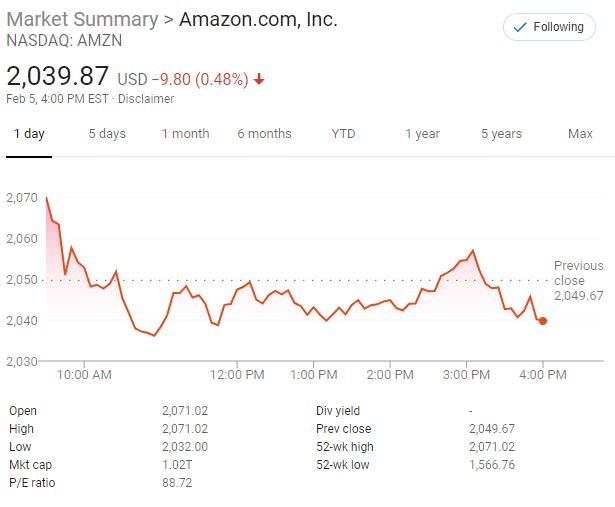

us stock market today