RWO Stock: A Comprehensive Review in US News

author:US stockS -

In the fast-paced world of finance, staying ahead of the curve is essential. One stock that has been making waves is RWO. In this article, we delve into the details of RWO stock, offering insights and analysis for investors and enthusiasts alike.

Understanding RWO Stock

RWO Stock: What Is It?

RWO stands for Real World Opportunities. It is a publicly-traded company based in the United States that focuses on creating innovative solutions to solve real-world problems. RWO's stock is listed on a major U.S. stock exchange, making it accessible to a wide range of investors.

The Rise of RWO

In recent years, RWO has gained significant attention in the market. The company has been able to differentiate itself by offering unique and impactful solutions across various sectors. Its stock has seen impressive growth, attracting the attention of both retail and institutional investors.

Key Factors Driving RWO's Stock Performance

1. Strong Revenue Growth RWO has been able to maintain strong revenue growth, largely due to its ability to adapt to changing market demands and deliver innovative solutions. This has translated into robust financial performance, reflected in the company's stock price.

2. Diversified Product Portfolio

3. Strategic Partnerships RWO has formed strategic partnerships with leading companies in various sectors. These partnerships have not only helped the company expand its reach but also enhanced its market position.

Analyzing RWO Stock Performance

To understand RWO stock better, let's look at some key performance metrics.

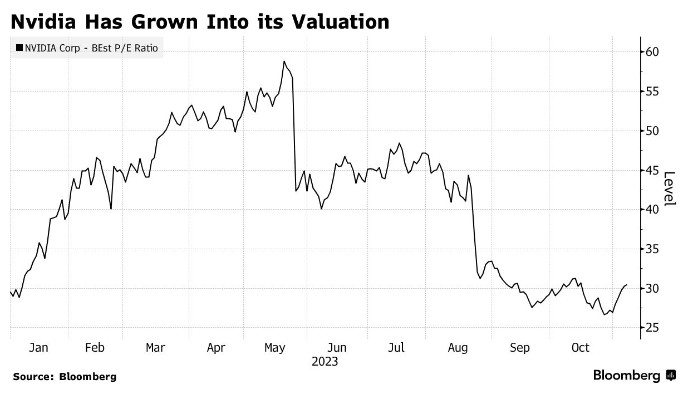

1. Price-to-Earnings (P/E) Ratio RWO's P/E ratio has been consistently improving over the past few years. This indicates that investors are willing to pay a premium for the company's growth prospects.

2. Earnings Per Share (EPS) The company's EPS has seen a steady increase, reflecting its strong financial performance. This trend is expected to continue in the coming years.

3. Dividend Yield RWO offers a decent dividend yield, making it an attractive option for income investors.

Case Study: RWO's Success in Renewable Energy

One of the notable successes of RWO has been in the renewable energy sector. The company developed an innovative technology that helps improve the efficiency of solar panels. This technology has been adopted by leading solar companies, boosting RWO's revenue and market share.

Conclusion

In conclusion, RWO stock presents an attractive investment opportunity for those looking to capitalize on the company's growth potential. With a strong revenue growth, diversified product portfolio, and strategic partnerships, RWO is well-positioned to continue its impressive performance. As investors, it's essential to keep a close eye on RWO stock and its progress in various sectors.

Disclaimer: The information provided in this article is for general knowledge and educational purposes only. It should not be considered professional financial advice.

us stock market today